On the last day of the week, Friday, the AUD/JPY cross rate declined for the second consecutive day, moving away from the annual high reached the day before. Currently, spot prices remain slightly below the round 101.00 level. However, the potential for further decline is limited.

News published on Friday confirmed that inflation in Japan remains stable and well above the Bank of Japan's 2% target. This backdrop keeps expectations of an imminent interest rate hike alive, providing a slight respite for proponents of a stronger Japanese yen. Additionally, Finance Minister Satsuki Katayama's statement sparked speculation that Japanese authorities might intervene to prevent further weakening of the national currency. Combined with falling stock markets, this has contributed to the yen's relative strengthening, which is viewed as a safe-haven currency compared to the more risky Australian dollar.

The Japanese Cabinet approved an economic stimulus program worth 21.3 trillion yen—a significant step for the new Prime Minister Sanae Takaichi. This initiative heightens concerns about the country's financial difficulties and the need to increase public debt, which has recently led to active growth in the yield curve, keeping borrowing costs at levels close to multi-year highs. Meanwhile, Takaichi's strategy regarding low interest rates further creates uncertainty surrounding future decisions by the Bank of Japan and dampens sentiments for yen growth, making aggressive purchases unlikely.

On the other hand, the Australian dollar received support from the "hawkish" tone of the Reserve Bank of Australia (RBA), which limited the decline of the AUD/JPY pair. The minutes of the November meeting highlighted concerns about further rate cuts in the context of high inflation and a resilient labor market. The central bank noted that rate cuts would only be possible if there were a significant deterioration in the labor market.

This approach demonstrates caution, and the uncertainty regarding further stimulus measures reduces the likelihood of interest rate cuts. As a result, it would be prudent to wait for signs of active selling before concluding that the AUD/JPY cross rate has reached a peak.

From a technical perspective, since the oscillators on the daily chart have not moved into negative territory, this suggests that spot prices are unlikely to see further growth. Prices are currently halted below the round level of 101.00. If they break through this level, they will encounter resistance at 101.70 on their way to the annual high around 102.50.

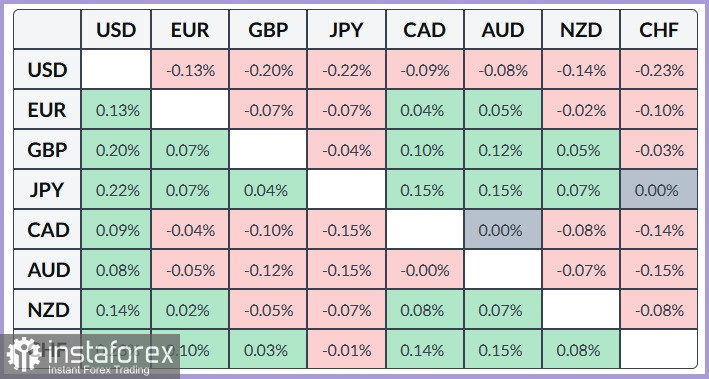

Price support has been found at the 14-day EMA, with additional support in the 100.30-100.10 zone before reaching the round level of 100.00. The table below shows the percentage change in the value of the Japanese yen against major currencies for Friday. The Japanese yen demonstrated the greatest strength against the US dollar.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română