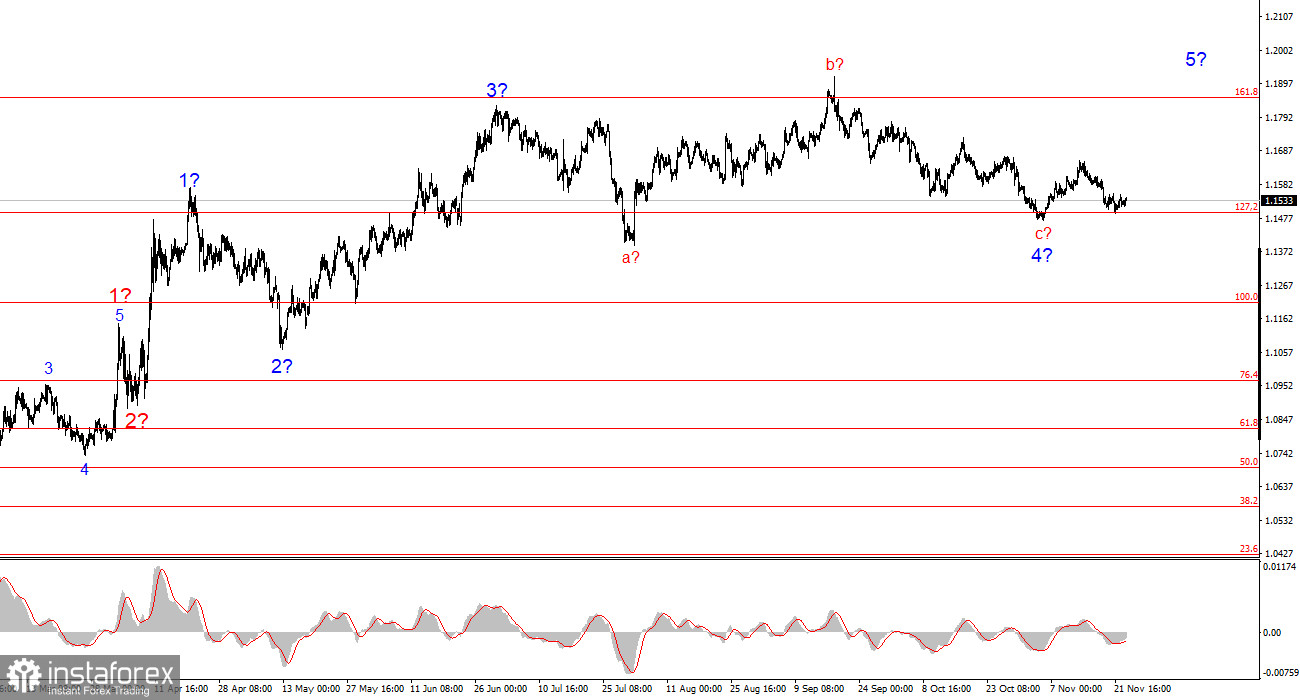

The 4-hour wave pattern for EUR/USD has transformed, but overall it remains quite clear. There is no talk of canceling the upward trend segment that began in January 2025, but the wave structure has become significantly more complex and extended since July 1. In my view, the pair is in the process of forming corrective wave 4, which has taken on an unconventional shape. Within this wave we see exclusively corrective structures, so there is no doubt about the corrective nature of the decline.

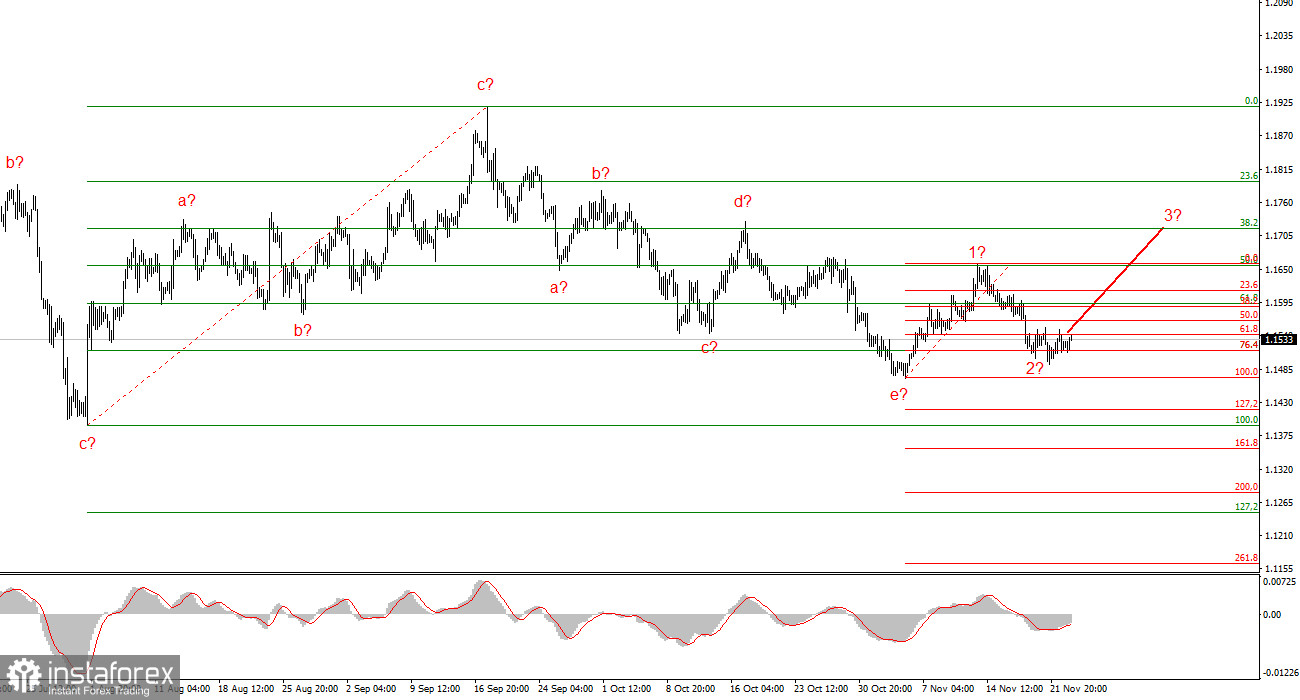

In my opinion, the formation of the upward trend segment is not complete, and its targets extend up to the 1.25 level. The a-b-c-d-e series of waves looks complete; therefore, I expect the formation of a new upward wave sequence in the coming weeks. We have seen the presumed wave 1 or a, and the pair is now in the process of forming wave 2 or b. I expected the second wave to end in the 38.2%–61.8% Fibonacci zone of the first wave, but quotes fell to 76.4%. Such a decline still allows for the formation of wave 3 or c.

The EUR/USD pair rose by 10 basis points during Tuesday by the start of the U.S. session. The intraday amplitude was 15 points. Naturally, the most active part of the day is still ahead — but lately the market has been "asleep" even during the U.S. session. There have been no economic reports today yet, but I cannot say that there is no news at all. Even if we ignore the government shutdown and the two rounds of Fed monetary easing in September and November, news is still arriving regularly.

What recent news can I highlight? First, sharply increased dovish expectations for the December Fed meeting. Of course, all FOMC policymakers insist that the regulator's decision will depend solely on the yet-to-be-released economic data on the labor market, unemployment, and inflation, but at the same time the new round of easing is now supported not only by the three "Trump-protege doves," but by at least a fourth one. John Williams has joined Waller, Bowman, and Miran, and he has also suddenly started to express strong concerns about the state of the U.S. labor market. Clearly, another rate cut is a bearish signal for the dollar.

Second, the war in Ukraine may end in the foreseeable future, which is also bad for the dollar. Recall that the U.S. currency remains a "safe haven" for investors. But this haven is needed when turmoil is raging somewhere in the world. When the opposite is true, demand for the U.S. dollar decreases. Therefore, further dollar decline remains the most logical scenario.

General Conclusions.

Based on the analysis of EUR/USD, I conclude that the pair continues to form an upward trend segment. In the last few months the market has taken a pause, but Donald Trump's policies and the Fed's stance remain significant factors for the future decline of the U.S. currency. The targets of the current trend segment may extend up to the 1.25 level. At this time, the formation of an upward wave series may continue. I expect that from current levels the pair will begin forming the third wave of this sequence, which may be either wave c or 3. At this time, I remain in long positions with targets around 1.1740, and the upward reversal of the MACD indicator gives slight confirmation to these expectations.

On the smaller scale, the entire upward trend segment is visible. The wave pattern is not entirely standard, since corrective waves vary in size. For example, the larger wave 2 is smaller than the internal wave 2 in 3. However, this also happens. I remind you that it is best to identify clear structures on charts, and not necessarily cling to every wave. Currently, the upward structure raises no doubts.

The main principles of my analysis:

- Wave structures should be simple and clear. Complex structures are difficult to trade and often trigger changes.

- If you are not confident about what is happening in the market, it is better not to enter it.

- There is no—and can never be—100% certainty about the direction of movement. Do not forget protective Stop Loss orders.

- Wave analysis can be combined with other types of analysis and trading strategies.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română