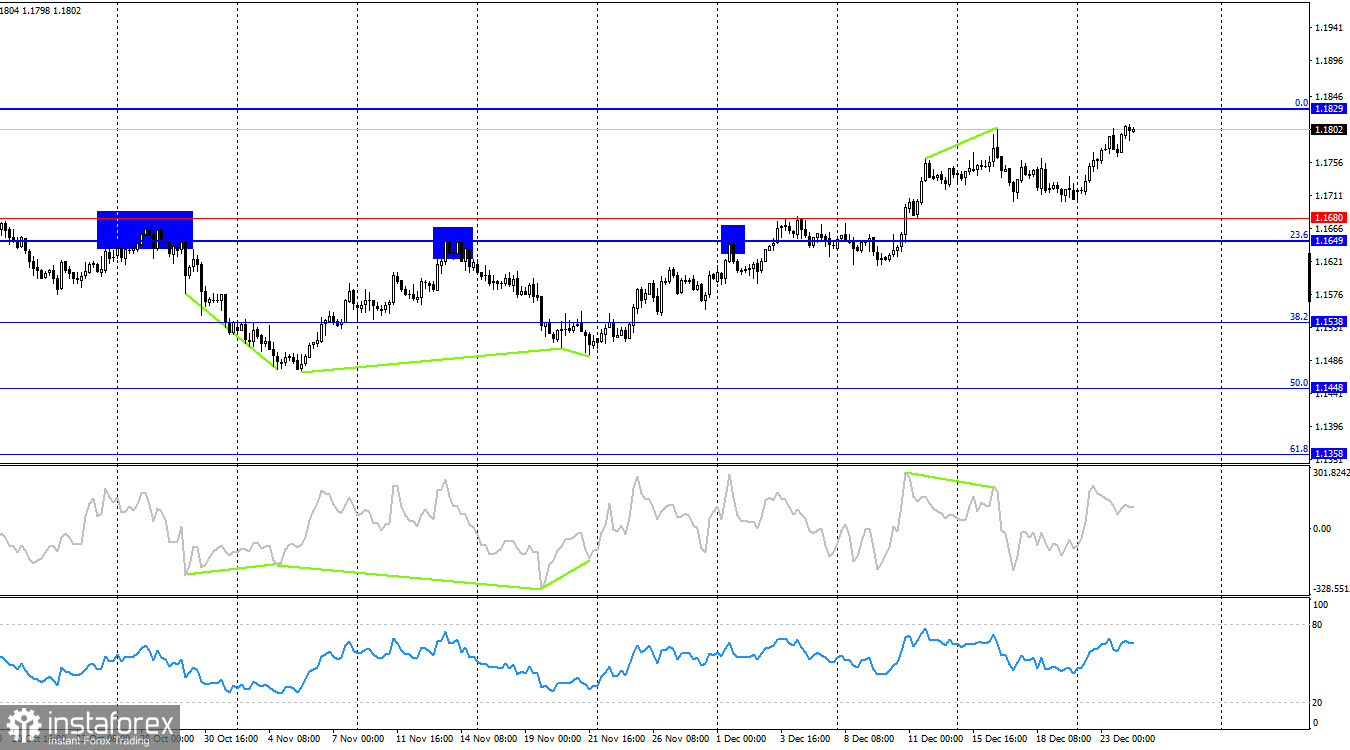

On Tuesday, the EUR/USD pair rose to the resistance level of 1.1795–1.1802, rebounded from it, and then posted a slight decline. The drop in euro quotes coincided with the release of U.S. reports, which we will discuss below. By Wednesday morning, the pair had returned to the 1.1795–1.1802 level. Today, a second rebound from this zone would once again work in favor of the U.S. dollar and lead to some decline toward the Fibonacci level of 38.2% at 1.1718. A consolidation above the zone would increase the likelihood of continued growth toward the next corrective level of 0.0% at 1.1919.

The wave situation on the hourly chart remains straightforward. The last completed upward wave broke above the peak of the previous wave, while the most recent downward wave failed to break the previous low. Thus, the trend officially remains "bullish." It would be hard to call it strong, but in recent weeks the bulls have regained confidence and are attacking with enthusiasm. The Fed's easing of monetary policy is putting pressure on the dollar, while the ECB is unlikely to create any problems for the euro in the near future.

On Tuesday, there was a news background. Traders could have expected the dollar to strengthen after the release of strong U.S. GDP data for the third quarter. The second estimate is not final, so in a month the market could see a completely different figure from the current +4.3% quarter-on-quarter. Nevertheless, U.S. economic growth turned out to be much stronger than expected, which triggered cautious bearish attacks. Why be cautious? Because in addition to the GDP report, two equally important reports were released—on durable goods orders and industrial production. The former declined by 2.2% in October versus forecasts of -1.5%, while the latter fell by 0.1% month-on-month against expectations of +0.1%. As a result, these two reports neutralized all the positive impact from the 4.3% growth in the U.S. economy. The dollar's rise was short-lived and very restrained. Further bullish attacks showed that bulls are ready for a new offensive toward the end of the year within the current bullish trend.

On the 4-hour chart, the pair reversed in favor of the European currency and resumed its growth toward the 0.0% corrective level at 1.1829. A rebound from this level would work in favor of the U.S. currency and lead to some decline toward the support level of 1.1649–1.1680. A consolidation above 1.1829 would increase the likelihood of further euro growth. No emerging divergences are observed on any indicators today.

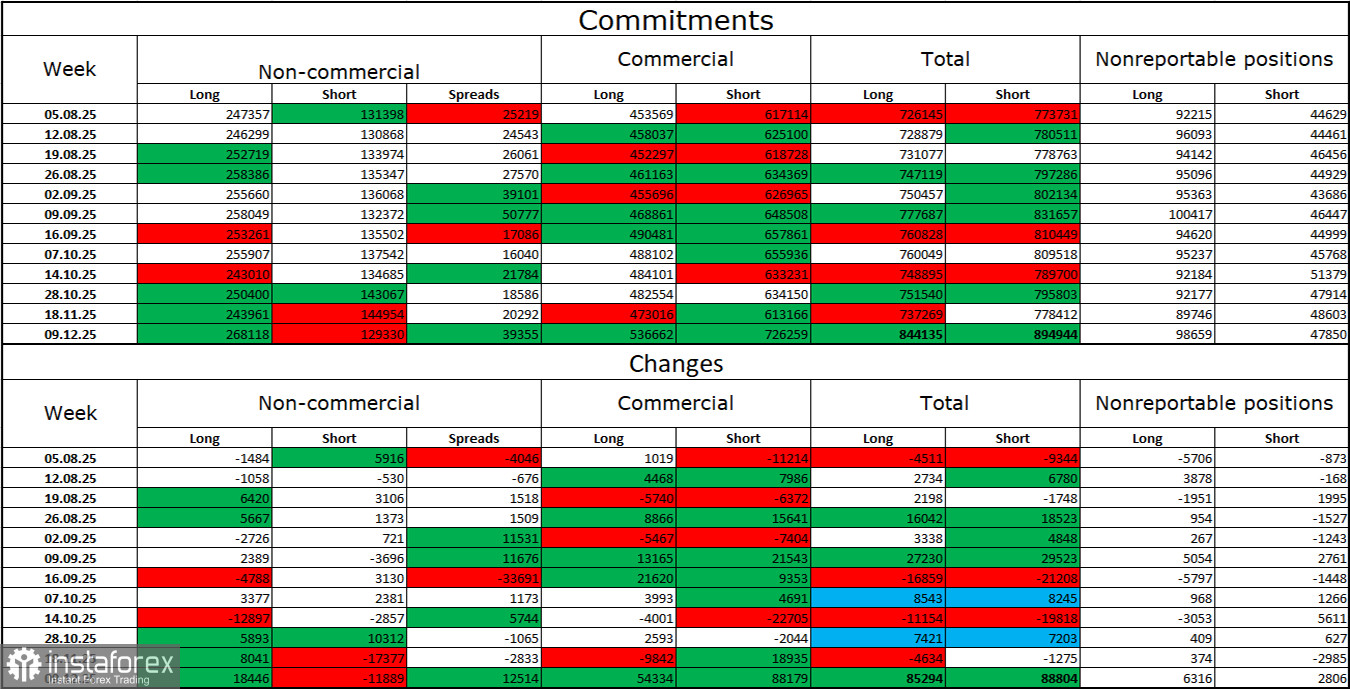

Commitments of Traders (COT) Report:

During the last reporting week, professional players opened 18,446 long positions and closed 11,889 short contracts. The sentiment of the "Non-commercial" group remains bullish thanks to Donald Trump and his policies, and it continues to strengthen over time. The total number of long positions held by speculators now stands at 268,000, while short positions total 129,000—giving bulls more than a twofold advantage.

For thirty-three consecutive weeks, large players were reducing short positions and increasing longs. Then the shutdown began, and now we are seeing the same picture again: bulls continue to build long positions. Donald Trump's policies remain the most significant factor for traders, as they are causing numerous problems that will have long-term and structural consequences for the United States—for example, the deterioration of the labor market. Despite the signing of several important trade agreements, analysts fear a recession in the U.S. economy, as well as a loss of the Fed's independence under pressure from Trump and amid Jerome Powell's expected resignation in May next year.

News Calendar for the U.S. and the Eurozone:

- U.S. – Initial Jobless Claims (13:30 UTC).

On December 24, the economic calendar contains only one minor entry. The impact of the news background on market sentiment on Wednesday will be absent.

EUR/USD Forecast and Trading Advice:

Selling the pair is possible if prices rebound from the 1.1795–1.1802 level on the hourly chart, with a target at 1.1718. Buy positions could be opened on a rebound from the 1.1718 level with a target at 1.1795–1.1802. The target has been reached. If the price closes above the 1.1795–1.1802 level, positions can be kept open with targets at 1.1829 and 1.1919.

The Fibonacci grids are drawn from 1.1392–1.1919 on the hourly chart and from 1.1066–1.1829 on the 4-hour chart.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română