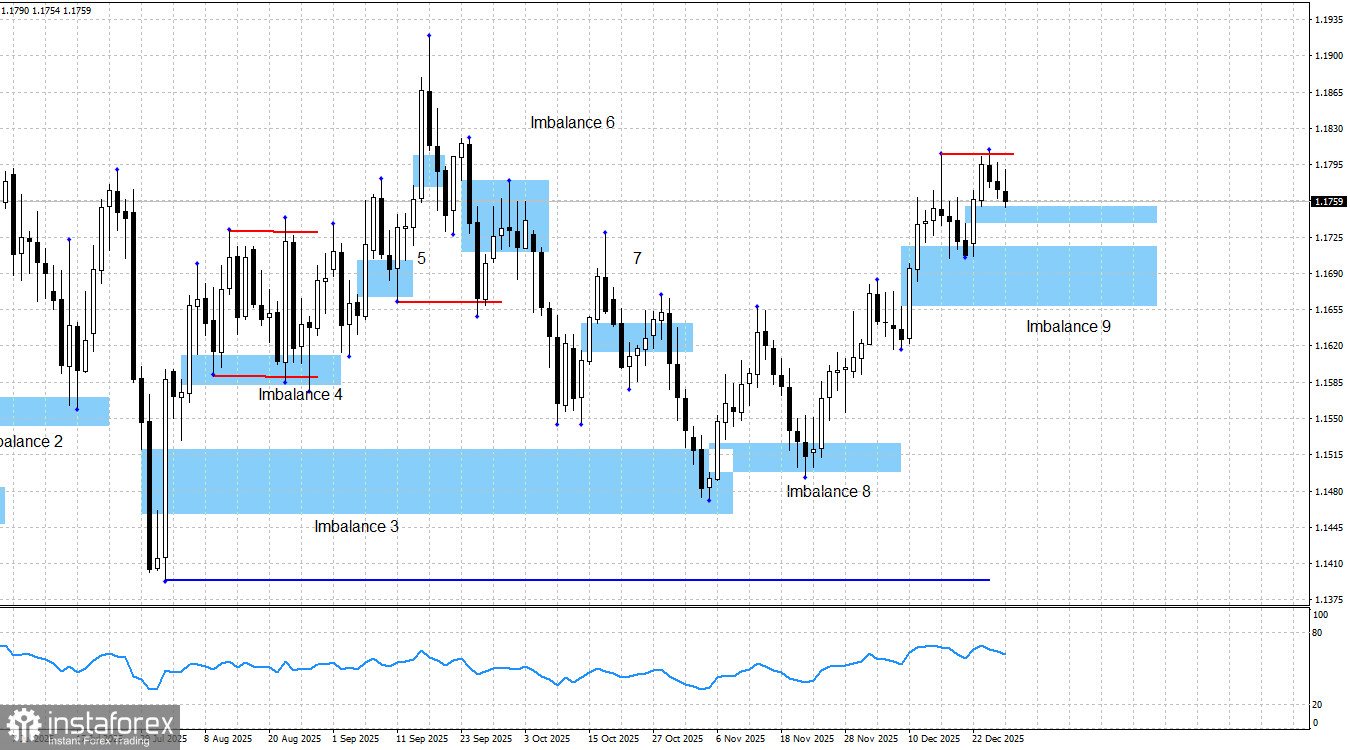

The EUR/USD pair bounced off the bullish imbalance 9 zone, which gave us another buy signal. Let me remind you that it all started earlier with bullish imbalances 3 and 8 as well. The pair formed two buy signals, and traders had an excellent opportunity to enter in continuation of the bullish trend at the most favorable price. At the moment, this trade is showing a profit of around 260 points. Traders can decide for themselves what to do next: wait for a larger profit or close the trade now. Personally, I am expecting further growth from the European currency.

Last week, liquidity was taken from the swing dated December 16, and the pair began a downward move. This decline is very weak, and liquidity grabs are not patterns—trades should not be opened based on them, nor should long-term conclusions be drawn. The decline in the pair may be completed at the next bullish imbalance, which was formed last week. Thus, a new bullish signal may already be formed this week, and looking a bit ahead, another bullish signal may also appear on GBP. I see absolutely no signs of the end of the bullish trend or the last bullish offensive.

The chart picture continues to signal bullish dominance. The bullish trend remains intact: a reaction to bullish imbalance 3 has occurred, a reaction to bullish imbalance 8 has occurred, and a reaction to bullish imbalance 9 has occurred. Despite a rather prolonged decline in the European currency, the dollar has still failed to break the bullish trend. It had five months to do so and achieved no result. If bearish patterns or signs of a breakdown of the bullish trend appear, the strategy can be adjusted. But at the moment, nothing points to this.

There was no news background on Monday, and trader activity ahead of the New Year and after Christmas was minimal.

Bulls have had plenty of reasons for a renewed offensive for three months now, and all of them remain relevant. These include the dovish (in any case) outlook for FOMC monetary policy, Donald Trump's overall policy (which has not changed recently), the confrontation between the U.S. and China (where only a temporary truce has been reached), protests against Trump (which have swept across America three times this year already), weakness in the labor market, bleak prospects for the U.S. economy (recession), and the government shutdown (which lasted a month and a half but was clearly not priced in by traders). Thus, further growth of the pair, in my view, will be completely natural.

One should also not lose sight of Trump's trade war and his pressure on the FOMC. Recently, new tariffs have been introduced less frequently, and Trump himself has stopped criticizing the Fed. However, I personally believe this is yet another "temporary calm." In recent months, the FOMC has been easing monetary policy, which is why there has been no new wave of criticism from Trump. But this does not mean that these factors no longer create problems for the dollar.

I still do not believe in a bearish trend. The informational background remains extremely difficult to interpret in favor of the dollar, which is why I am not even trying to do so. The blue line shows the price level below which the bullish trend could be considered complete. Bears would need to push the price down by about 400 points to reach it, and I consider this task impossible under the current informational background and circumstances. The nearest upside target for the European currency remains the bearish imbalance at 1.1976–1.2092 on the weekly chart, which was formed back in June 2021.

News Calendar for the U.S. and the Eurozone:

On December 30, the economic calendar contains no noteworthy events. The influence of the news background on market sentiment on Tuesday will be absent.

EUR/USD Forecast and Trading Advice:

In my view, the pair may be in the final stage of the bullish trend. Despite the fact that the information background remains on the side of the bulls, bears have attacked more frequently in recent months. Nevertheless, I currently see no realistic reasons for the start of a bearish trend.

From imbalances 1, 2, 4, and 5, traders had opportunities to buy the euro. In all cases, we saw some degree of growth. Traders also had opportunities to open new trend-following buy positions after reactions to bullish imbalance 3, after the reaction to imbalance 8, and then after the bounce from imbalance 9. This week, a reaction to bullish imbalance 10 may occur. The growth target for the euro remains the 1.1976 level. Buy positions can be kept open, with Stop Loss orders moved to breakeven.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română