However, dovish expectations regarding the U.S. Federal Reserve may limit further dollar gains. In addition, the European Central Bank has stopped cutting interest rates, which should support the single currency and the currency pair. At the moment, the pair is trading near the four-week low around 1.1690, as traders closely monitor possible U.S. actions in Venezuela, against the backdrop of several important U.S. macroeconomic releases scheduled for this week.

Venezuelan President Nicolas Maduro is expected to appear before a U.S. court on Monday after being captured by U.S. forces over the weekend. U.S. President Donald Trump has warned of potential new actions against the country if Venezuelan authorities fail to cooperate with the United States on opening up their oil sector and combating drug trafficking.

It is worth noting, however, that market sentiment following the weekend events has remained largely unchanged. Major Asian indices are trading in positive territory, while European markets are showing a moderately positive open.

In the currency markets, the trend of U.S. dollar strengthening that began last week has continued. Strong U.S. data on home sales and unemployment claims have reinforced confidence in the Federal Reserve, which is maintaining a very gradual cycle of monetary policy easing.

To identify better trading opportunities today, attention should be paid to the release of the U.S. Manufacturing PMI to confirm current expectations. However, the key event of the week will be the Nonfarm Payrolls report for December, scheduled for release on Friday.

From a technical perspective, the Relative Strength Index (RSI) has fallen below 50, indicating that bullish momentum is weakening. Nevertheless, as long as prices remain above the 100-day simple moving average (SMA), bulls still have a chance to regain control. The gradually rising 100-day SMA continues to support the broader trend, although a daily close below it would shift the balance in favor of the bears. Prices have found support right near the 100-day SMA, while the round 1.1700 level has now become resistance.

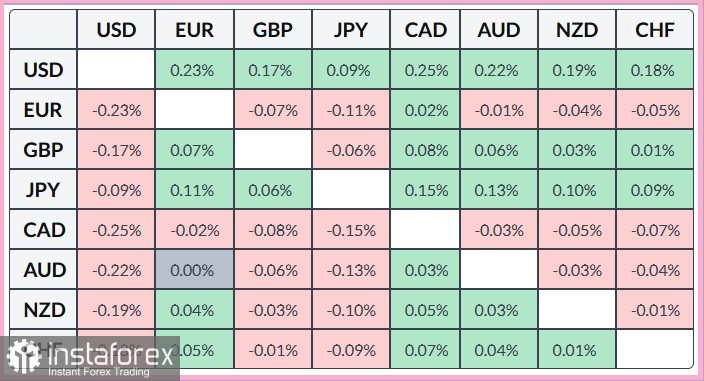

Below is the change in the euro's exchange rate against major currencies today. The euro has shown a notable gain against the Canadian dollar.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română