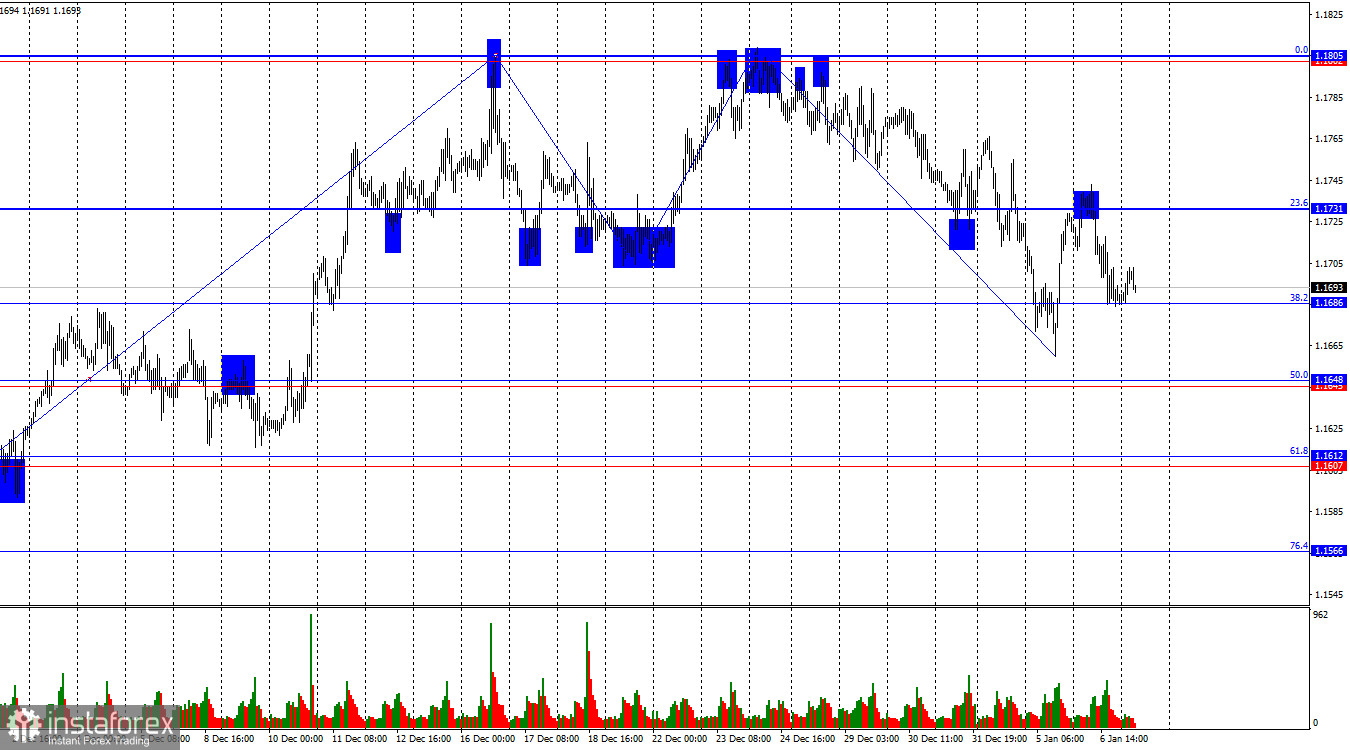

The wave structure on the hourly chart remains straightforward. The most recent completed upward wave failed to break the previous peak, while the new downward wave broke the prior low. Thus, the trend has shifted to bearish. In my view, the decline will not be prolonged, but a break of the bearish trend is now required before expecting renewed euro growth. According to the current chart setup, such a break would occur above the resistance zone at 1.1795–1.1802 or after two consecutive bullish waves.

On Tuesday, nothing seemed to threaten the European currency. Traders had fully priced in the arrest of Maduro and Donald Trump's new geopolitical ambitions, but unexpectedly the dollar received support from Germany's inflation report. The slowdown in German inflation in December from 2.3% to 1.8% year-on-year, versus expectations of 2.0%, came as a complete surprise to traders. It is still too early to draw firm conclusions, but the probability of ECB monetary tightening in 2026 dropped sharply yesterday. If inflation continues to fall, tightening policy is not feasible, as higher rates would further restrain the consumer price index. It was precisely the ECB's high rates in 2023–2024 that allowed inflation to be reduced from the record post-pandemic levels. Thus, the euro's decline on Tuesday was justified, and today bears may continue their attacks if European inflation also shows a significant slowdown. However, it should not be forgotten that U.S. economic data will also be released today, which could give bulls additional strength.

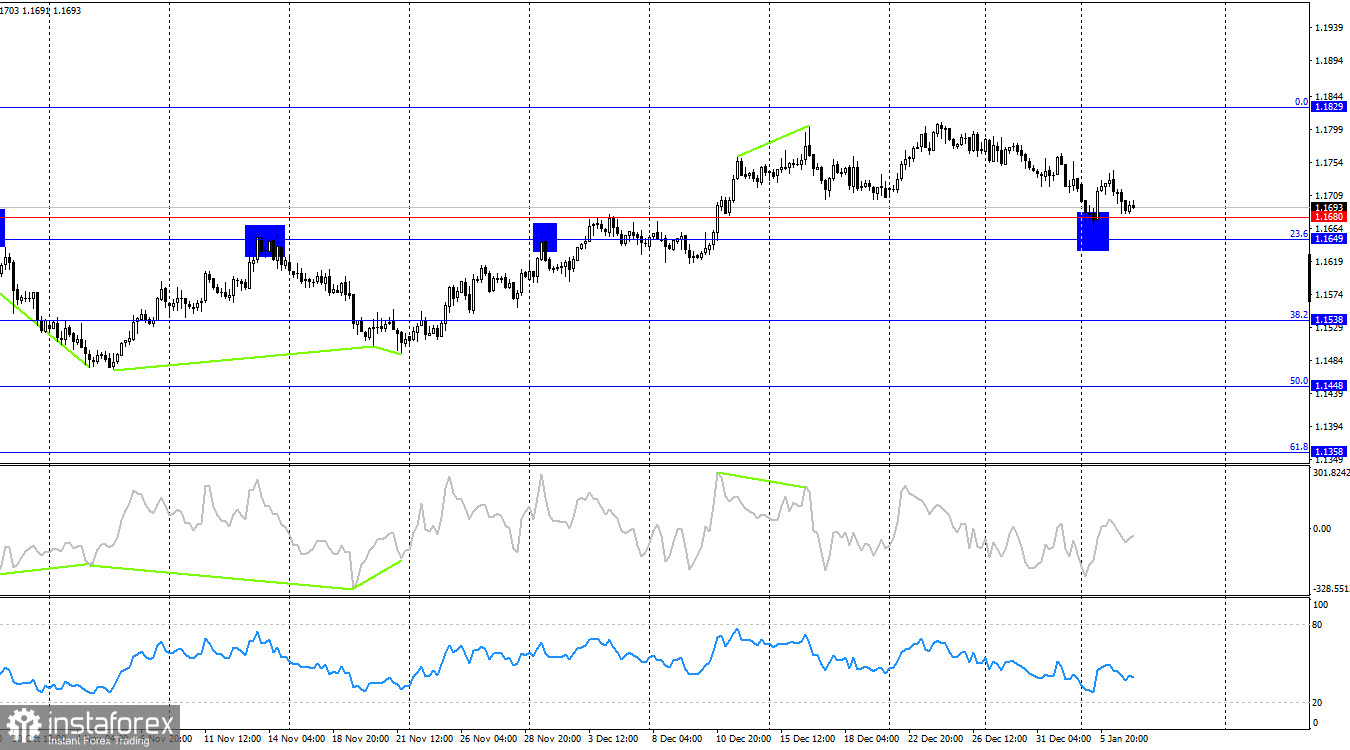

On the 4-hour chart, the pair rebounded from the 1.1649–1.1680 support zone and reversed in favor of the euro. As a result, the growth process may continue toward the 0.0% retracement level at 1.1829. A consolidation below the 1.1649–1.1680 support area would increase the chances of a further decline toward the next Fibonacci level of 38.2% at 1.1538. No emerging divergences are observed on any indicator today.

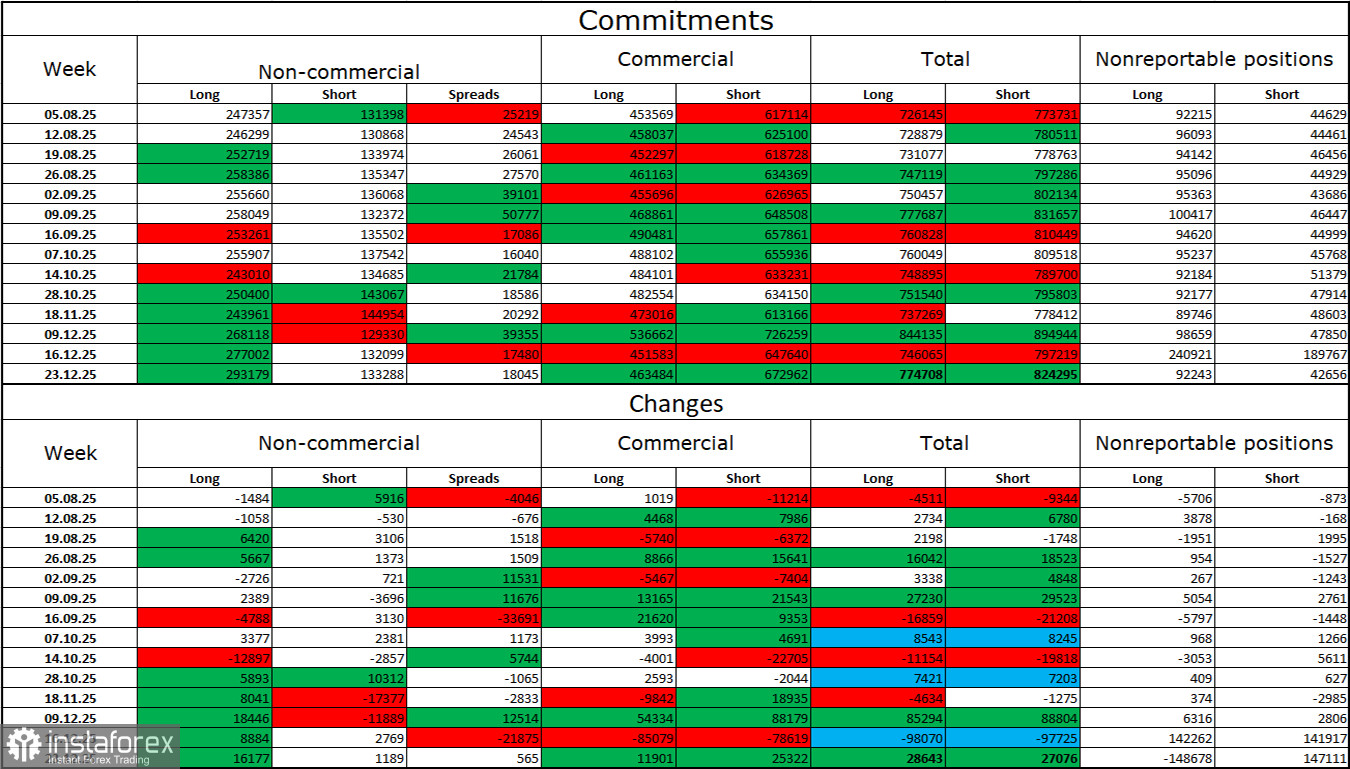

Commitments of Traders (COT) Report:

During the latest reporting week, professional players opened 16,177 long positions and 1,189 short positions. Sentiment among the "non-commercial" group remains bullish thanks to Donald Trump and his policies, and continues to strengthen over time. The total number of long positions held by speculators now stands at 293,000, while short contracts amount to 133,000—giving bulls more than a twofold advantage.

For thirty-three consecutive weeks, large players were reducing short positions and increasing long ones. Then the shutdown began, and now we see the same picture again: professional traders continue to build long positions. Donald Trump's policies remain the most significant factor for traders, as they generate numerous problems that will have long-term, structural consequences for the U.S. economy—such as deterioration in the labor market. Traders fear a loss of Federal Reserve independence in 2026 under pressure from Trump, especially amid Jerome Powell's resignation expected in May.

Economic Calendar for the U.S. and the Eurozone:

- Eurozone – Change in German Retail Sales (07:00 UTC)

- Eurozone – German Unemployment Rate (08:55 UTC)

- Eurozone – Change in German Unemployment (08:55 UTC)

- Eurozone – Consumer Price Index (10:00 UTC)

- United States – ADP Employment Change (13:15 UTC)

- United States – ISM Services PMI (15:00 UTC)

- United States – JOLTS Job Openings (15:00 UTC)

On January 7, the economic calendar contains seven events, four of which are very important (U.S. data and European inflation). The impact of the news background on market sentiment on Wednesday may be strong, especially in the second half of the day.

EUR/USD Forecast and Trading Advice:

Selling the pair was possible after a rebound from the 1.1731 level on the hourly chart, with a target at 1.1686. The target was reached. Today, short positions can be opened after a close below 1.1686, with targets at 1.1648 and 1.1612. Buying opportunities will arise on a rebound from 1.1686 on the hourly chart, with targets at 1.1731 and 1.1805.

The Fibonacci grids are drawn from 1.1492 to 1.1805 on the hourly chart and from 1.1066 to 1.1829 on the 4-hour chart.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română