The GBP/USD currency pair continued to trade more sideways than up or down on Wednesday. Although, unlike the euro, the pound sterling is not stuck in a flat for seven months, in recent weeks we have precisely observed a flat. The British pound does not want to fully emulate the euro, so from time to time it demonstrates more or less noticeable moves for form's sake. But few would deny the fact that volatility has fallen sharply in recent months for the GBP/USD pair.

We continue to adhere to the same point of view as before. First of all, we want to note that one should not look for explanations where none exist. Many experts now constantly report on new plans by Trump to seize Greenland or stage a coup in Mexico, or to attack Iran. The media trumpet about a criminal investigation against Jerome Powell. Macroeconomic data on the US labor market, unemployment, and inflation have provided plenty of reasons for the market not to stand still. And no, none of these events are "empty" or secondary. But the problem is not that they are insignificant; it is that the market does not want to work them through.

Recall that the market is people. If a Nonfarm Payrolls report comes out and you see a disastrous number, are you obliged to open a trade to sell the dollar? No. You may only do it if you want. The same applies to interbank trading. Whatever news comes from the US, no one is obliged in the literal sense to react to it immediately. Recall that the market often likes to price in events in advance, in anticipation. In some cases, it accumulates factors for future trends. If the pair made a fully logical, consistent move every time, everyone would make money in the market. The point is that the market works much more complexly, and it is run by people whose goal is to profit at others' expense.

Let us return to the confrontation between Trump and Powell. It is no secret that the trial of Powell makes no sense insofar as Trump's influence on Fed monetary policy is concerned. So why is it needed? First, revenge. Powell ignored Trump's requests for eight years, and the US president is not the sort to forget slights. Second, as a lesson to other FOMC members. If every Fed official understands that today they will not vote for a rate cut and tomorrow they may receive a court summons for having crossed someone eight years ago, then the probability of dovish decisions will be much higher. Recall that Trump already "removed" Adriana Kugler, attempted to sack Lisa Cook, and now Jerome Powell is next. In the future, the same fate could befall any other FOMC member. As a result, Trump continues the war with the Fed until total victory or total defeat. There can be no other outcome in this confrontation.

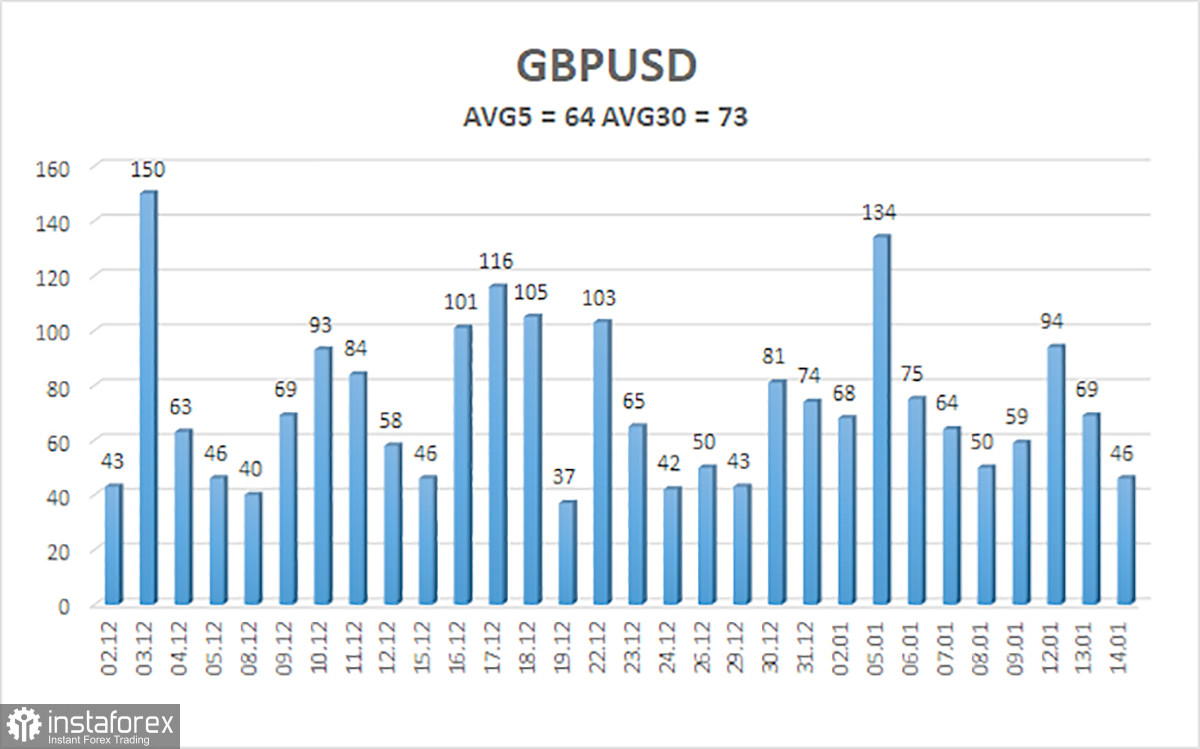

Average volatility of the GBP/USD pair over the last 5 trading days is 64 pips. For the pound/dollar pair, this value is "medium." On Thursday, January 15, we therefore expect movement within a range bounded by levels 1.3364 and 1.3500. The higher linear regression channel has turned upward, indicating trend recovery. The CCI indicator entered the oversold area 6 times over recent months and formed numerous "bullish" divergences, which have consistently warned traders of the continuation of the uptrend.

Nearest support levels:

S1 – 1.3428

S2 – 1.3306

S3 – 1.3184

Nearest resistance levels:

R1 – 1.3550

R2 – 1.3672

R3 – 1.3794

Trading recommendations:

The GBP/USD pair is trying to resume the 2025 uptrend, and its long-term prospects have not changed. Donald Trump's policies will continue to pressure the US economy, so we do not expect the US currency to strengthen. Thus, long positions with targets at 1.3550 and 1.3672 remain relevant in the near term as long as the price stays above the moving average. A price below the moving average line allows considering small shorts with a target of 1.3364 on technical grounds. From time to time, the US currency shows corrections (in the global sense), but for a trend to strengthen, it needs global positive factors.

Explanations of the illustrations:

- Linear regression channels help determine the current trend. If both are directed the same way, the trend is strong.

- The moving average line (settings 20,0, smoothed) indicates the short-term trend and the direction in which trading should proceed.

- Murray levels are target levels for moves and corrections.

- Volatility levels (red lines) indicate the likely price channel in which the pair will trade over the next 24 hours based on current volatility.

- CCI indicator — its entry into oversold territory (below -250) or overbought territory (above +250) signals an approaching trend reversal.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română