Monday's Trade Analysis:

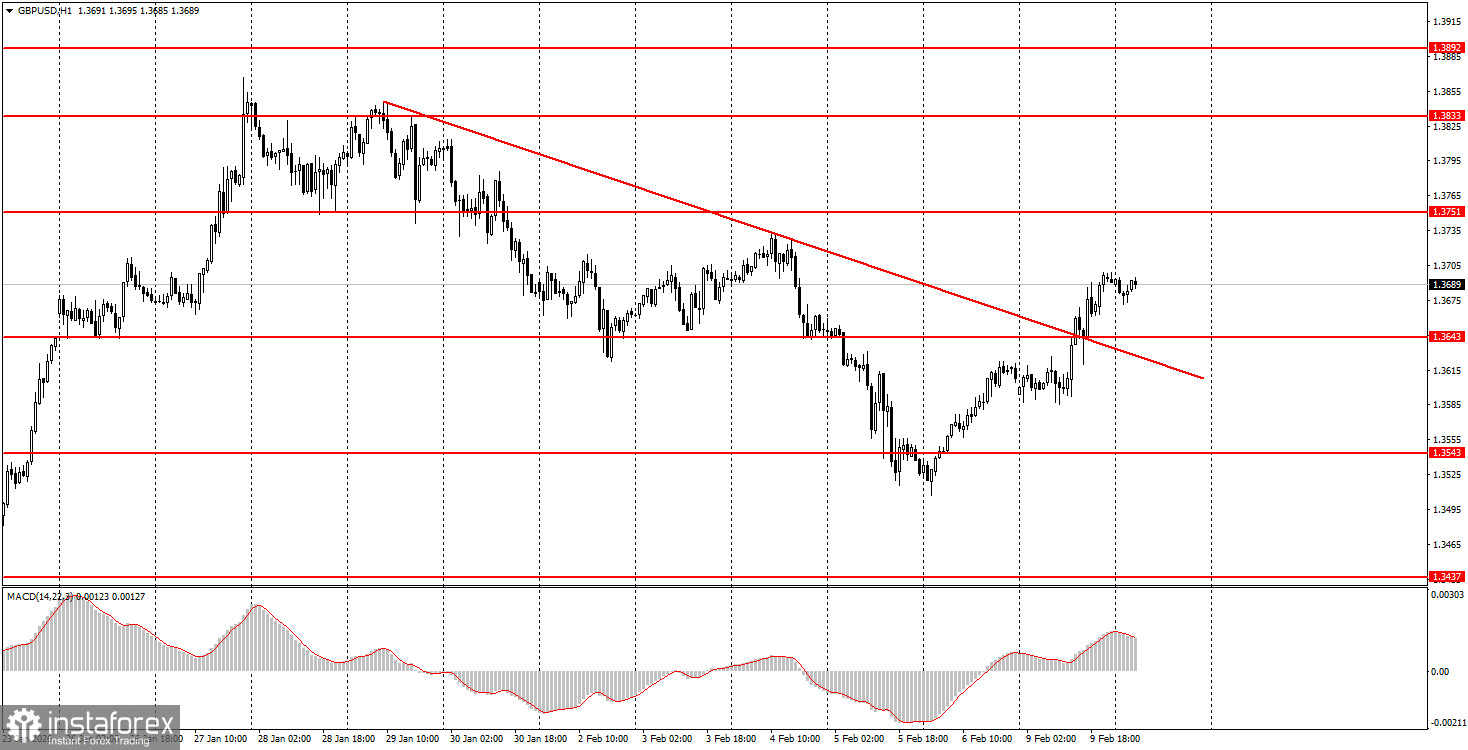

1H Chart of the GBP/USD Pair

The GBP/USD pair also traded higher on Monday amid another decline in market interest in the US dollar. The pound sterling has recently been in a downward trend. Yesterday, the price broke through the descending trend line, which changed the trend to upward. Thus, we saw a fairly strong correction against the upward trend visible on any higher timeframe. We may be entering a new phase of this trend. Recall that last week, four reports on the US labor market were due to be published. Only two—the least important—were released. However, even these reports showed another deterioration in labor market conditions. This week, the missing NonFarm Payrolls and unemployment rate reports will be released, which could create serious pressure on the dollar. If the labor market remains at the levels of recent months, the Federal Reserve will once again approach a rate cut. The dollar will decline even without new monetary policy easing from the Fed. With easing, it will just fall faster and more intensely.

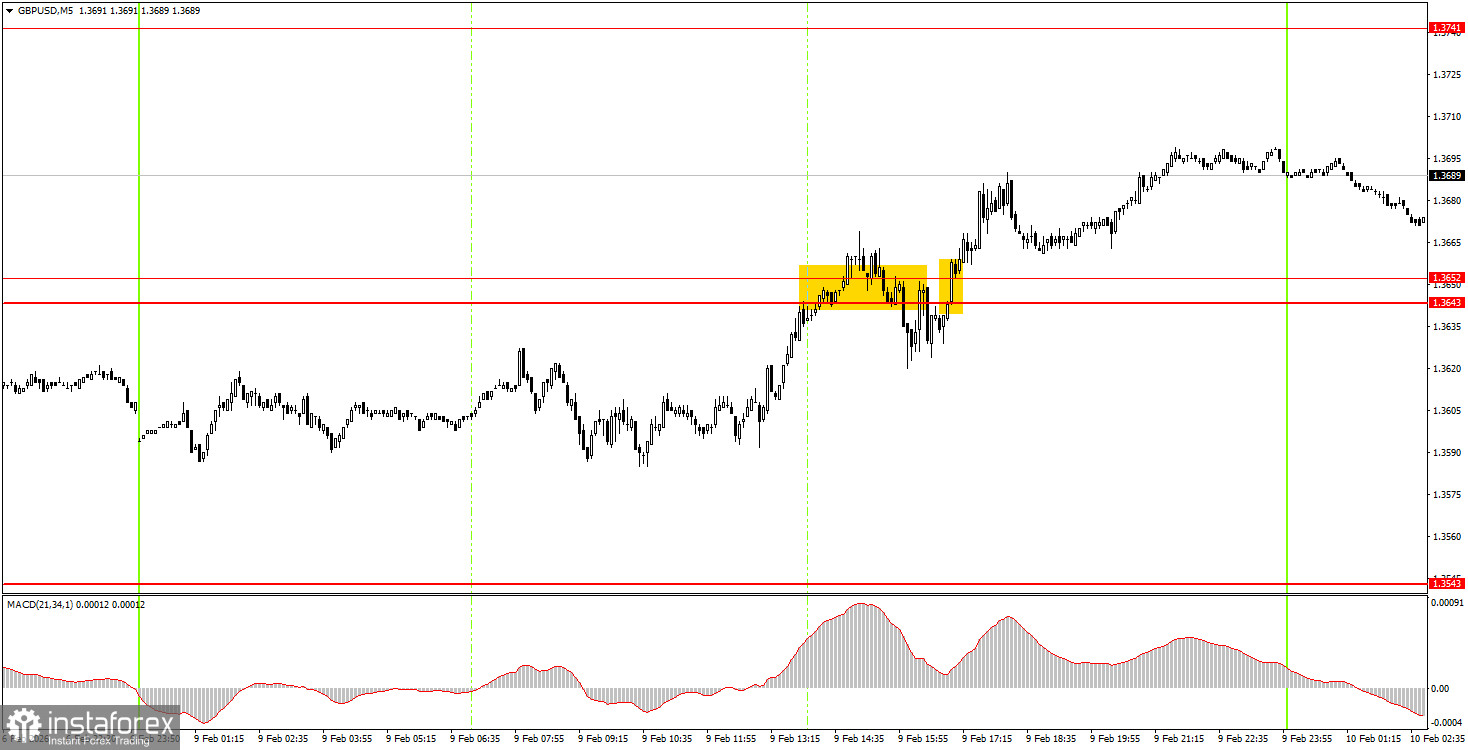

5M Chart of the GBP/USD Pair

On the 5-minute timeframe, the signals formed on Monday were not the best. During the American trading session, the price first bounced from the 1.3643-1.3652 area, then broke through it. The first signal proved blatantly false, while the second allowed beginner traders to make a few dozen pips. Long positions could have been carried over into today, as the trend line was broken, and growth will likely continue.

How to Trade on Tuesday:

On the hourly timeframe, the GBP/USD pair has broken the downward trend. There are no global grounds for medium-term dollar growth, so in 2026, we expect the continuation of the global upward trend from 2025, which could push the pair to at least 1.4000. In recent weeks, the situation has not favored the British currency, but the pound now has every chance of returning to the 38 level.

On Tuesday, beginner traders may consider short positions if the pair consolidates below the 1.3643-1.3652 area, with a target of 1.3529-1.3543. A consolidation above the area of 1.3643-1.3652 allows for remaining in longs with a target of 1.3741-1.3751.

On the 5-minute timeframe, trading levels to consider include 1.3319-1.3331, 1.3365, 1.3403-1.3407, 1.3437-1.3446, 1.3484-1.3489, 1.3529-1.3543, 1.3643-1.3652, 1.3741-1.3751, 1.3814-1.3832, 1.3891-1.3912, and 1.3975. On Tuesday, there are no interesting events or reports scheduled in the UK, and in the US, traders may focus only on the retail sales report.

Main Rules of the Trading System:

- The strength of the signal is determined by the time it takes to form (rebound or breaking through the level). The shorter the time, the stronger the signal.

- If two or more trades were opened around a particular level based on false signals, all subsequent signals from that level should be ignored.

- In a flat market, any pair can generate numerous false signals or no signals at all. In any case, it is best to stop trading at the first signs of a flat.

- Trades are opened during the time period between the start of the European session and until the middle of the American session, after which all trades should be manually closed.

- On the hourly timeframe, signals from the MACD indicator should ideally be traded only when there is good volatility and a trend confirmed by a trend line or channel.

- If two levels are too close to each other (ranging from 5 to 20 pips), they should be considered as a support or resistance area.

- After moving 20 pips in the correct direction, it is advisable to set the Stop Loss to break-even.

What's on the Charts:

- Support and resistance levels are targets for opening buy or sell trades. Take Profit levels can be placed around them.

- Red lines indicate channels or trend lines that reflect the current trend and indicate the preferred direction for trading now.

- The MACD indicator (14,22,3) – the histogram and signal line – serves as a supplementary indicator that can also be used as a source of signals.

- Important speeches and reports (always found in the news calendar) can significantly influence the movement of the currency pair. Therefore, during their release, trading should be conducted with maximum caution, or it is advised to exit the market to avoid a sharp price reversal against the preceding movement.

- Beginners trading in the Forex market should remember that not every trade can be profitable. Developing a clear strategy and practicing sound money management are the keys to long-term trading success.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română