Trade Review and Trading Advice for the British Pound

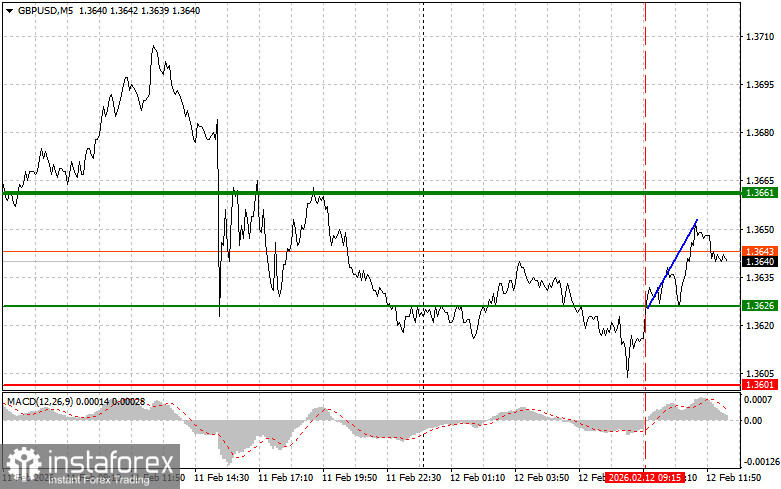

The test of the 1.3626 level occurred when the MACD indicator had just begun moving upward from the zero line, confirming a proper entry point for buying the pound. As a result, the pair rose by more than 30 points.

The UK GDP growth figure of 0.1% fully matched economists' forecasts, which triggered no market reaction. Although this stagnation in economic growth was expected, it nevertheless highlights the current challenges facing the British economy. Weak growth points to ongoing uncertainty and potential difficulties in achieving a stronger recovery. Since the data met expectations, there were no surprises to provoke sharp market movements. Traders likely had already priced these figures into their strategies and are now shifting their focus to other, more significant U.S. events and reports.

Attention will turn to U.S. weekly initial jobless claims and existing home sales data. Although these indicators may seem unrelated, together they provide valuable insight into the condition of the U.S. labor market and housing sector—two pillars of the national economy. Understanding their dynamics allows analysts and traders to make more informed decisions. A sharp increase in jobless claims may signal rising layoffs, pointing to slowing business activity or problems in certain industries. Conversely, a steady decline in claims suggests growing employer confidence, a willingness to expand payrolls, and a healthy labor market. Existing home sales, in turn, reflect consumer confidence and mortgage affordability.

Weak U.S. data would likely lead to further gains in GBP/USD, continuing the morning trend.

As for the intraday strategy, I will mainly rely on the implementation of Scenarios No. 1 and No. 2.

Buy Signal

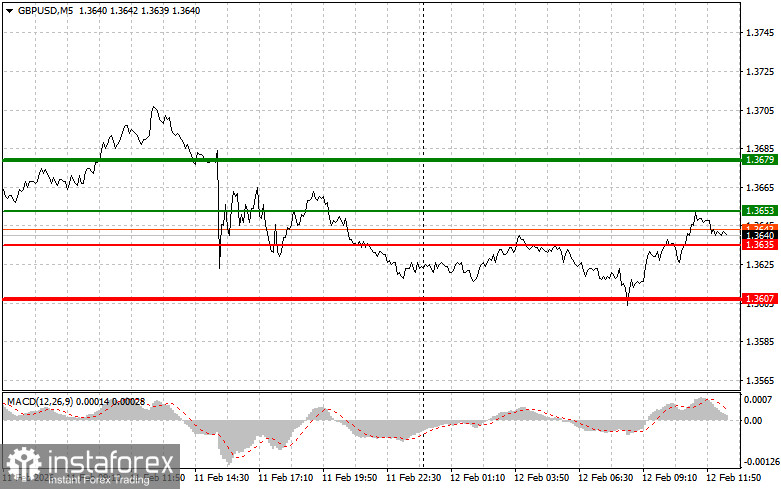

Scenario No. 1: Today, I plan to buy the pound upon reaching the entry point around 1.3653 (green line on the chart), with a target of 1.3679 (thicker green line on the chart). Around 1.3679, I will exit long positions and open short positions in the opposite direction (targeting a 30–35 point move from that level). The pound can be expected to rise today following weak U.S. data.Important: Before buying, make sure the MACD indicator is above the zero line and just beginning to move upward from it.

Scenario No. 2: I also plan to buy the pound today in the case of two consecutive tests of the 1.3635 level while the MACD indicator is in the oversold area. This would limit the pair's downward potential and trigger a market reversal upward. Growth toward the opposite levels of 1.3653 and 1.3679 can be expected.

Sell Signal

Scenario No. 1: Today, I plan to sell the pound after a break of the 1.3635 level (red line on the chart), which would likely lead to a rapid decline. The key target for sellers will be 1.3607, where I will exit short positions and immediately open long positions in the opposite direction (targeting a 20–25 point move). Pressure on the pound will return today if strong U.S. data is released.Important: Before selling, make sure the MACD indicator is below the zero line and just beginning to decline from it.

Scenario No. 2: I also plan to sell the pound today in the case of two consecutive tests of the 1.3653 level while the MACD indicator is in the overbought area. This would limit the pair's upward potential and lead to a downward reversal. A decline toward the opposite levels of 1.3635 and 1.3607 can be expected.

Chart Explanation:

- Thin green line – entry price for buying the trading instrument;

- Thick green line – estimated Take Profit level or an area to manually lock in profits, as further growth above this level is unlikely;

- Thin red line – entry price for selling the trading instrument;

- Thick red line – estimated Take Profit level or an area to manually lock in profits, as further decline below this level is unlikely;

- MACD indicator – when entering the market, it is important to rely on overbought and oversold zones.

Important. Beginner Forex traders should make market entry decisions very carefully. Before major fundamental reports are released, it is best to stay out of the market to avoid sharp price fluctuations. If you choose to trade during news releases, always place stop-loss orders to minimize losses. Without stop-loss orders, you can quickly lose your entire deposit, especially if you do not use proper money management and trade large volumes.

And remember, successful trading requires a clear trading plan, like the one outlined above. Spontaneous trading decisions based solely on the current market situation are an inherently losing strategy for an intraday trader.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română