Bitcoin retraced to around $67,300 yesterday but has returned to $69,000 today. Ethereum remains below $2,000, intensifying short-term pressure on it.

Meanwhile, there are increasing discussions in the market that the recent mass sales of BTC by investors, retail players, and smaller market participants often signal the formation of a market bottom. When panicked retail investors sell their assets en masse, it signals that pessimism has reached a peak. Generally, it is at such moments when market sentiment is at its lowest and most of the weak hands have exited the game that the foundations for subsequent recovery begin to be laid. This phenomenon has been observed many times across various market cycles, highlighting that the behavior of small investors often serves as a counter-indicator.

The data from the "fear and greed" index only confirms this theory. During bullish markets, retail investors, under the influence of euphoria, tend to buy at peaks, while in bearish markets, overwhelmed by fear, they tend to sell at lows. A mass exit of such investors from the market means that the most emotional and least informed segment of participants has already rid themselves of their positions, clearing the way for more patient and foresighted players.

As for my intraday strategy in the cryptocurrency market, I will continue to act on major pullbacks in Bitcoin and Ethereum, anticipating the continuation of the long-term bullish market, which hasn't gone away.

For short-term trading, the strategy and conditions are outlined below.

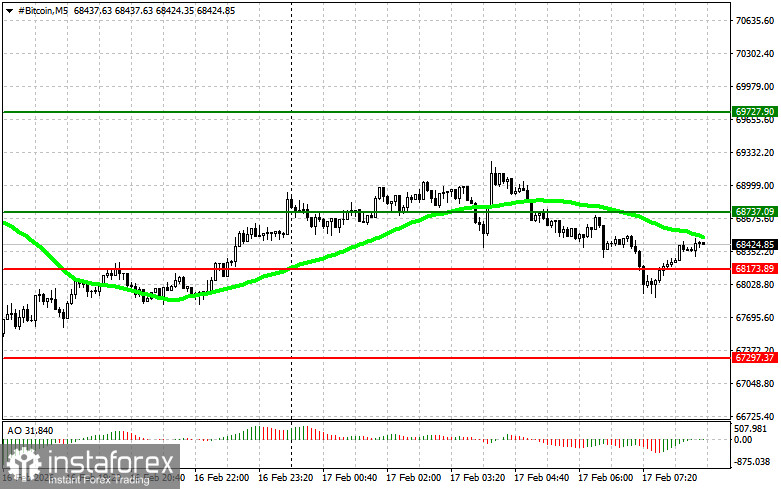

Bitcoin

Buy Scenario

- Scenario 1: I will buy Bitcoin today if it reaches the entry point around $68,800, targeting a rise to $69,700. At around $69,700, I will exit the buy position and sell immediately on the bounce. Before buying on a breakout, ensure that the 50-day moving average is below the current price and that the Awesome indicator is above zero.

- Scenario 2: I can buy Bitcoin from the lower boundary at $68,100 if there is no market reaction to its breakout in the opposite direction towards levels of $68,800 and $69,100.

Sell Scenario

- Scenario 1: I will sell Bitcoin today if it reaches the entry point around $68,100, targeting a decline to $67,300. Around $67,300, I will exit from the sell position and buy immediately on the bounce. Before selling on a breakout, ensure that the 50-day moving average is above the current price and that the Awesome indicator is below zero.

- Scenario 2: I can sell Bitcoin from the upper boundary at $68,800 if there is no market reaction to its breakout in the opposite direction towards levels of $68,100 and $67,300.

Ethereum

Buy Scenario

- Scenario 1: I will buy Ethereum today if it reaches the entry point around $1,989, targeting a rise to $2,025. Around $2,025, I will exit from the buy position and sell immediately on the bounce. Before buying on a breakout, ensure that the 50-day moving average is below the current price and that the Awesome indicator is above zero.

- Scenario 2: I can buy Ethereum from the lower boundary at $1,969 if there is no market reaction to its breakout in the opposite direction towards levels of $1,989 and $2,025.

Sell Scenario

- Scenario 1: I will sell Ethereum today if it reaches the entry point around $1,969, targeting a decline to $1,939. Around $1,939, I will exit from the sell position and buy immediately on the bounce. Before selling on a breakout, ensure that the 50-day moving average is above the current price and that the Awesome indicator is below zero.

- Scenario 2: I can sell Ethereum from the upper boundary at $1,989 if there is no market reaction to its breakout in the opposite direction towards levels of $1,969 and $1,939.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română