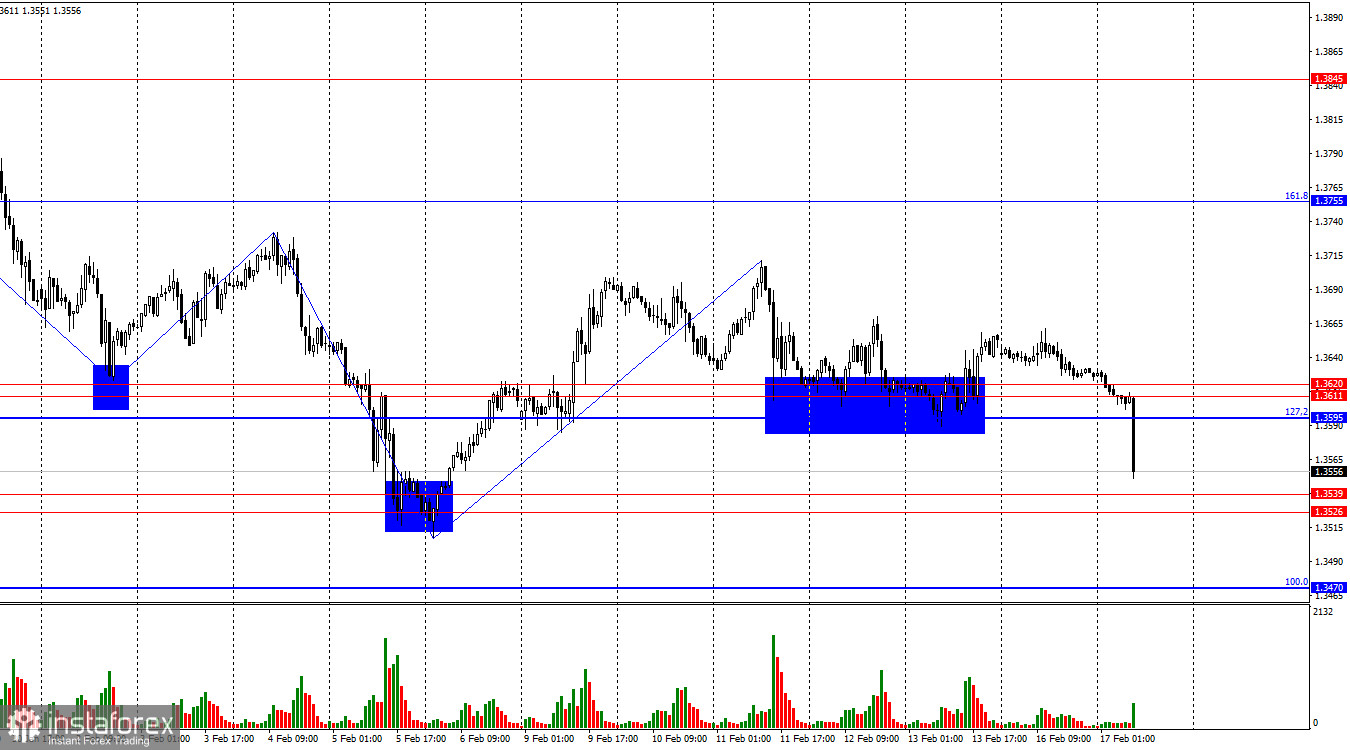

On the hourly chart, the GBP/USD pair on Monday made another pullback to the support level of 1.3595–1.3620, while bullish traders once again demonstrated complete detachment from what is happening in the world. On Tuesday morning, bears applied strong pressure to the pair and secured a break below the 1.3595–1.3620 level. Thus, the decline in quotes may continue toward the next support level of 1.3526–1.3539. A consolidation below this zone will increase the likelihood of further decline toward the Fibonacci level of 100.0% at 1.3470.

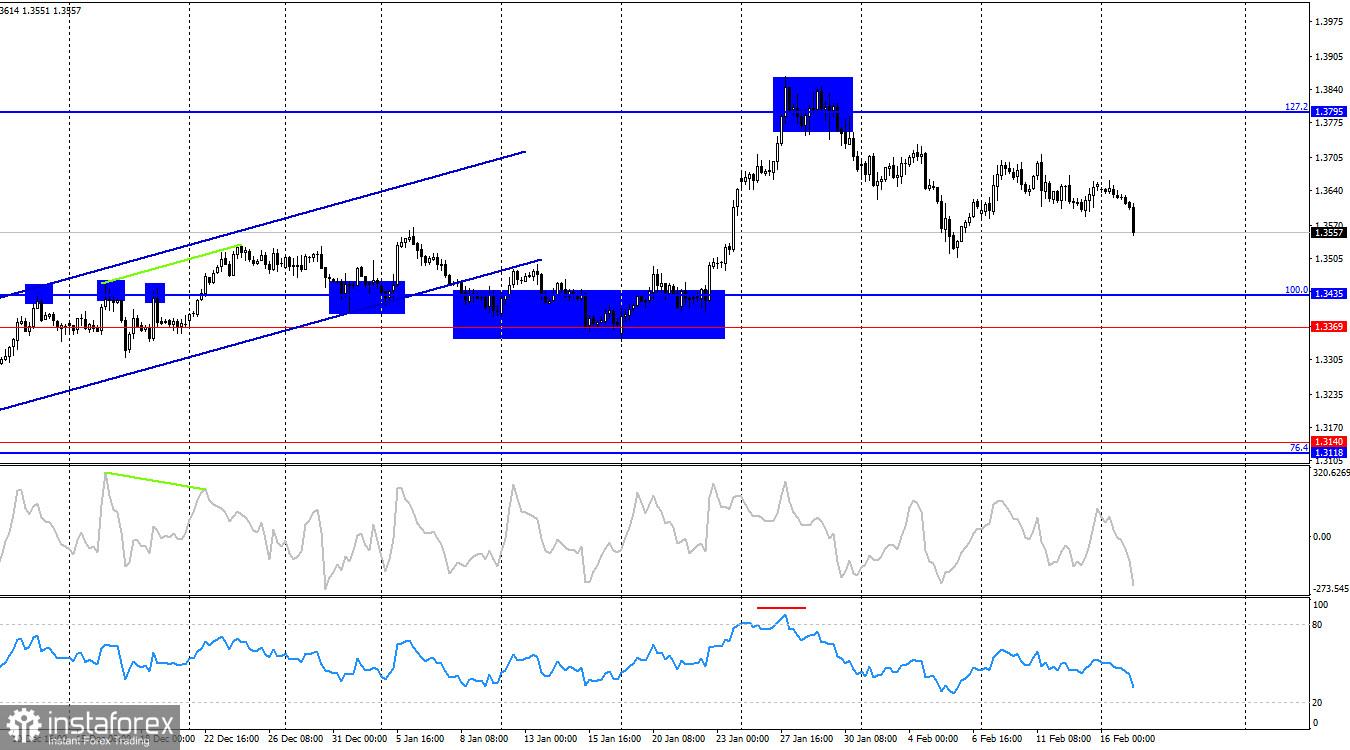

The wave structure remains "bearish." The last completed downward wave broke the previous low, while the last upward wave failed to break the previous high. To shift the trend back to "bullish," a consolidation above the last peak at 1.3730 or two consecutive bullish waves are required. The news background for the pound has been weak in recent months, but the news background in the United States has also rarely brought real optimism to traders. Bulls are regularly supported by Donald Trump and the weakness of the U.S. labor market.

There was no news background in the UK on Monday, while the United States observed a holiday — Presidents' Day. No, it is not Donald Trump's birthday. This morning, several important reports were released in the UK, but bearish traders needed only one — the unemployment rate, which unexpectedly rose to 5.2%. Reports on wages and jobless claims were largely ignored. The pound once again plunged, providing further confirmation of bullish passivity. Let me remind you that last week the bulls had every reason to attack, both based on the Nonfarm Payrolls data for the entire year 2025 and the January inflation report. But they chose not to take advantage of the opportunity. Exactly — chose not to. Thus, the bears continue to attack at present only because the bulls are unwilling to take any active steps.

On the 4-hour chart, the pair rebounded from the Fibonacci level of 127.2% at 1.3795 and has since continued declining toward the support level of 1.3369–1.3435. The bearish trend on the hourly chart is not complete. A consolidation above 1.3795 would allow for expectations of a continuation of the bullish trend toward 1.4020. No emerging divergences are currently observed on any indicator.

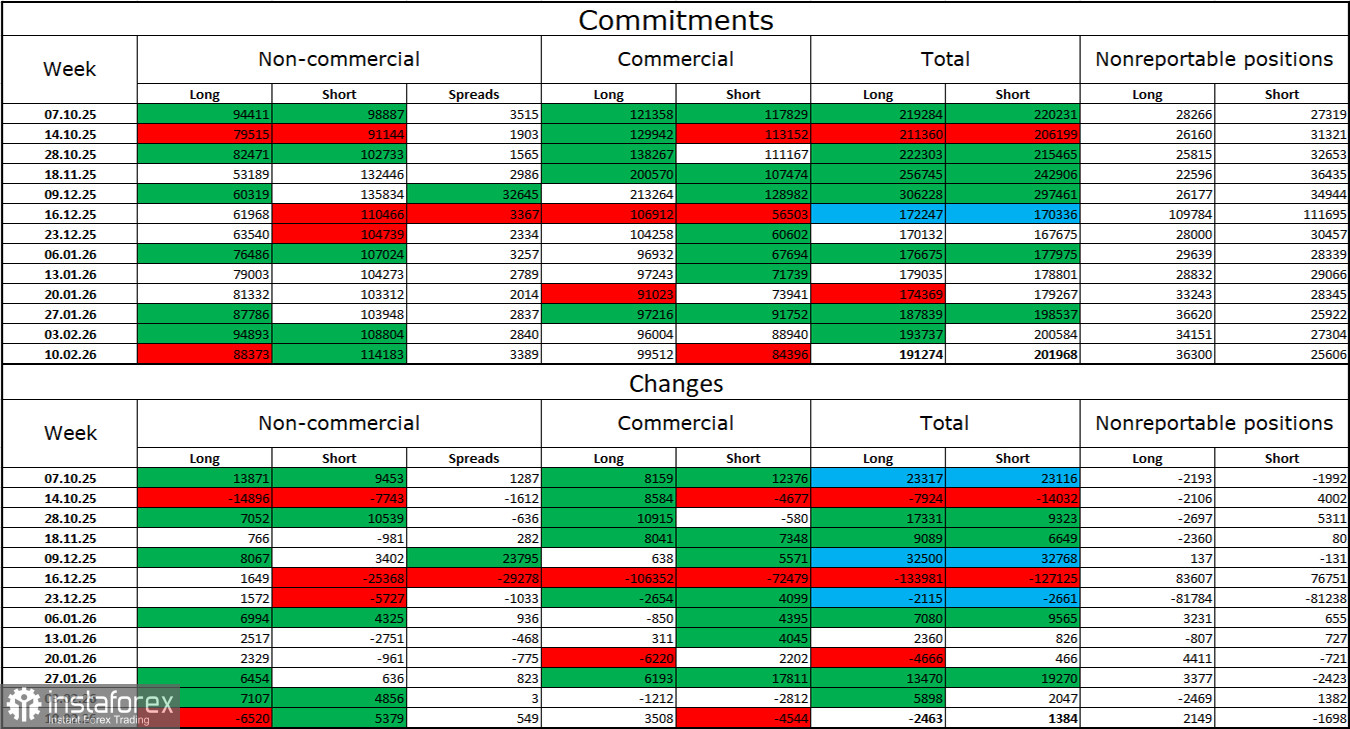

Commitments of Traders (COT) Report:

The sentiment of the "Non-commercial" trader category became slightly less bullish over the latest reporting week. The number of long positions held by speculators decreased by 6,520, while short positions increased by 5,379. The gap between long and short positions is now effectively 88,000 versus 114,000, and overall it is narrowing. In recent months, bears have dominated, but it seems they may have exhausted their potential. At the same time, the situation with euro contracts is directly opposite. I still do not believe in a bearish trend for the pound under any circumstances.

In my view, the pound still appears less "dangerous" than the dollar — and that is its main advantage. In the short term, the U.S. currency may enjoy intermittent demand in the market. But not in the long term. Donald Trump's policies have led to a sharp deterioration in the labor market, and the Federal Reserve is forced to ease monetary policy to stimulate job creation. U.S. military aggression also does not add optimism for dollar bulls.

News Calendar for the US and UK:

- UK — Unemployment Rate (07:00 UTC).

- UK — Average Earnings Index (07:00 UTC).

- UK — Claimant Count Change (07:00 UTC).

- US — ADP Employment Change (13:15 UTC).

On February 17, the economic calendar contains four entries, with the UK reports drawing particular interest. The impact of the news background on market sentiment on Tuesday will be felt primarily in the morning.

GBP/USD Forecast and Trading Tips:

Selling the pair was possible after consolidation below the 1.3595–1.3620 level on the hourly chart, targeting 1.3526–1.3539. These trades can be kept open today. Buying may be considered on a rebound from the 1.3526–1.3539 level or after consolidation above 1.3595–1.3620 on the hourly chart, targeting 1.3755.

Fibonacci retracement grids are built from 1.3470–1.3010 on the hourly chart and from 1.3431–1.2104 on the 4-hour chart.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română