It should also be remembered to my readers that there are currently at least three "doves" within the FOMC. It remains to be seen whether Christopher Waller and Michelle Bowman are ready to continue carrying out Trump's wishes now that the coveted chair of the Fed chair has gone to someone else. I remind you that recently, Waller and Bowman have actively voted for policy easing due to the "cooling" of the labor market. However, at that time, they were direct candidates for Jerome Powell's position, and it is now known that Kevin Warsh will be the next chair.

As I mentioned, it is highly likely that the former "hawk" Warsh will quickly turn into a "dove," but even with the votes of Waller and Bowman (as well as Steve Miran), they will only be four, which is not enough to fulfill Donald Trump's cherished desire. If Waller and Bowman change their stance on rates, then the next round of easing will really be seen only when inflation approaches the Fed's target level.

By the way, I suggest taking a closer look at inflation data over the past year to understand why Fed officials doubt the indicator's movement toward the target. When we look at, for example, a three-year chart, it becomes clear that since June 2024, US inflation has been hovering between 2.3% and 3.0%. Perhaps this is what causes the officials' doubts? The consumer price index is close to the target but has not reached it over the past year and a half.

At the same time, another Fed official, Michael Barr, also stated that he would prefer to wait for more convincing evidence of inflation reduction before voting for a rate cut, provided that the labor market remains stable. He noted the Fed's good position, which allows time for consideration and for gathering statistical information. I would add that after the speeches of Barr and Goolsbee, according to the CME FedWatch tool, the likelihood of a new round of easing in March has dropped to 6%, in April to 22%, and in June it remains unchanged at around 50%. In my opinion, the strengthening of the US dollar will be restrained within the framework of a corrective wave scenario.

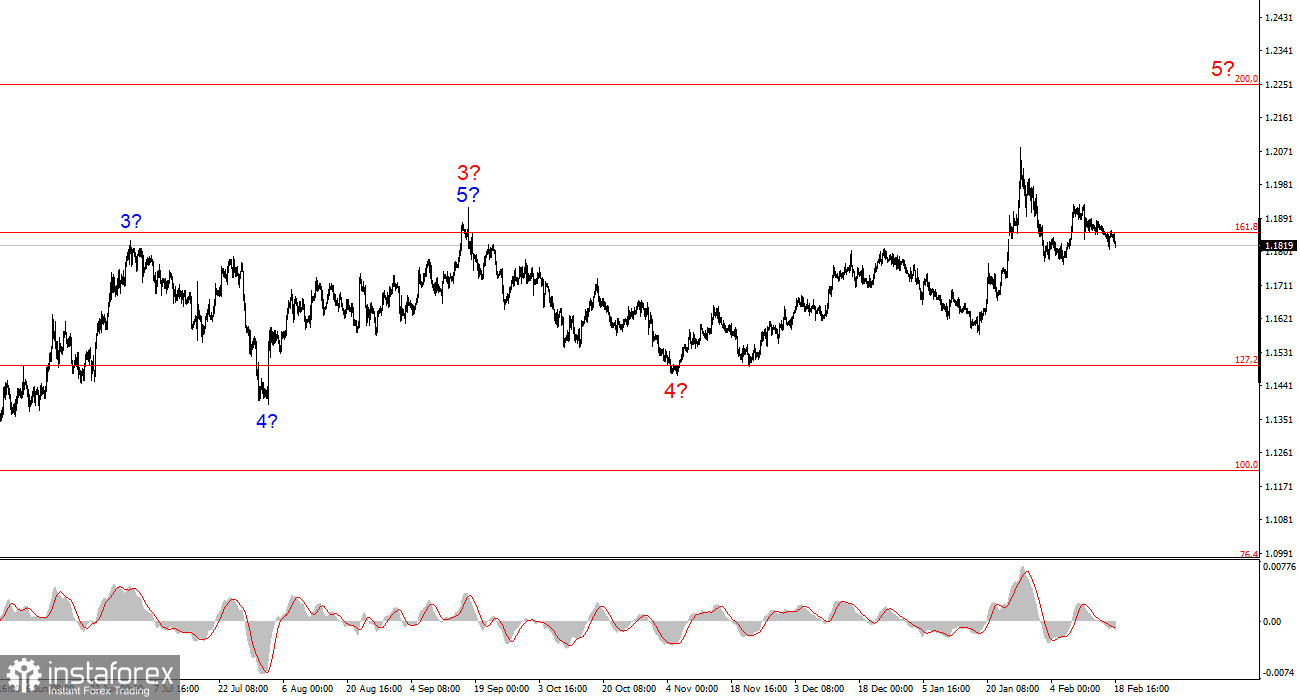

Wave Picture for EUR/USD:

Based on the analysis of EUR/USD, I conclude that the instrument continues to build an upward trend segment. The policies of Donald Trump and the Fed's monetary policy remain significant factors in the long-term decline of the American currency. The targets for the current segment of the trend may extend up to the 25th figure. At the moment, I believe the instrument remains within the global wave 5, so I expect an increase in quotes in the first half of 2026. However, in the near term, the instrument may form another downward wave as part of a correction. I believe it is wise to look for areas and levels for new purchases with targets near the marks of 1.2195 and 1.2367, which correspond to 161.8% and 200.0% on the Fibonacci.

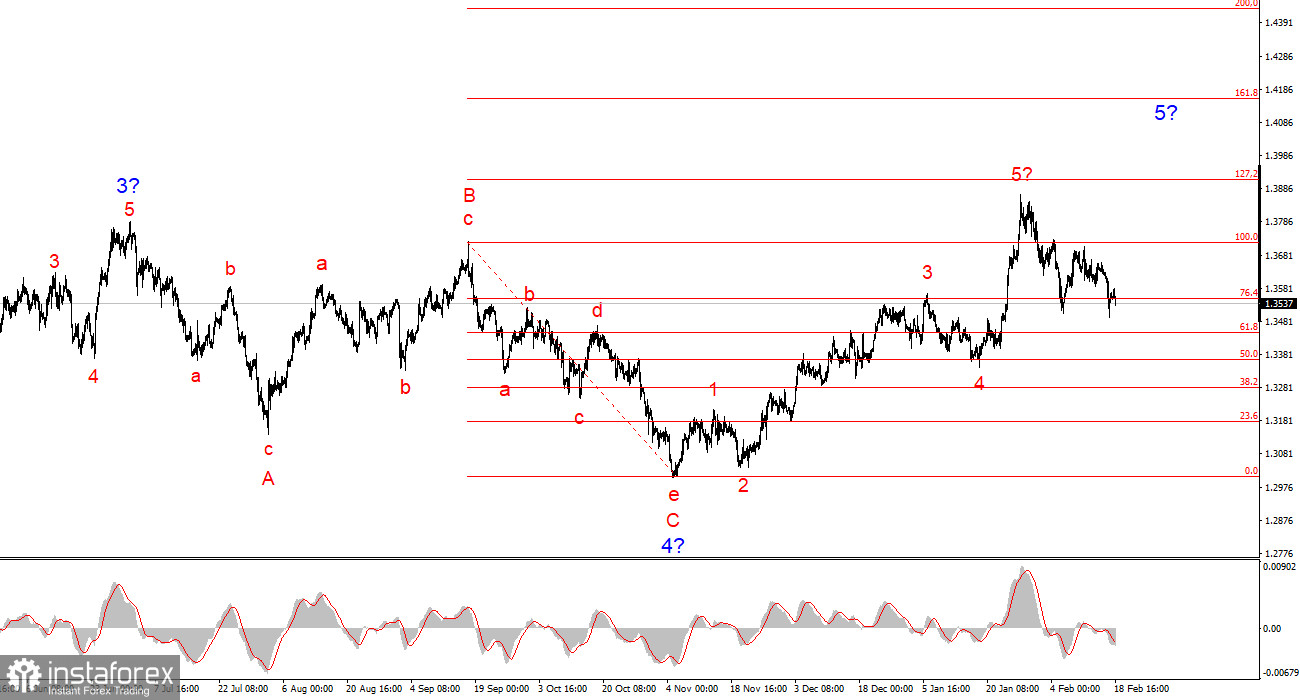

Wave Picture for GBP/USD:

The wave picture for the GBP/USD instrument is quite clear. The five-wave upward structure has completed its formation, but the global wave 5 may take on a much more extended form. I believe a corrective wave set may form in the near future, after which the upward trend will resume. Accordingly, in the coming weeks, I would advise looking for opportunities for new purchases. In my opinion, under Donald Trump, the pound has a good chance of rising to $1.45-1.50. Trump himself welcomes the decline of the dollar, and the Fed has the opportunity to lower rates again at the next meeting.

Key Principles of My Analysis:

- Wave structures should be simple and clear. Complex structures are difficult to play and often require changes.

- If there is no confidence in what is happening in the market, it is better not to enter.

- There is never 100% certainty in the direction of movement. Don't forget about protective Stop Loss orders.

- Wave analysis can be combined with other types of analysis and trading strategies.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română