Tesla shares have taken a hit due to supply chain issues. Analysts estimate the stock has slumped by 25% over the past month. However, there is a silver lining: Tesla shares are still up 21% since the US presidential election.

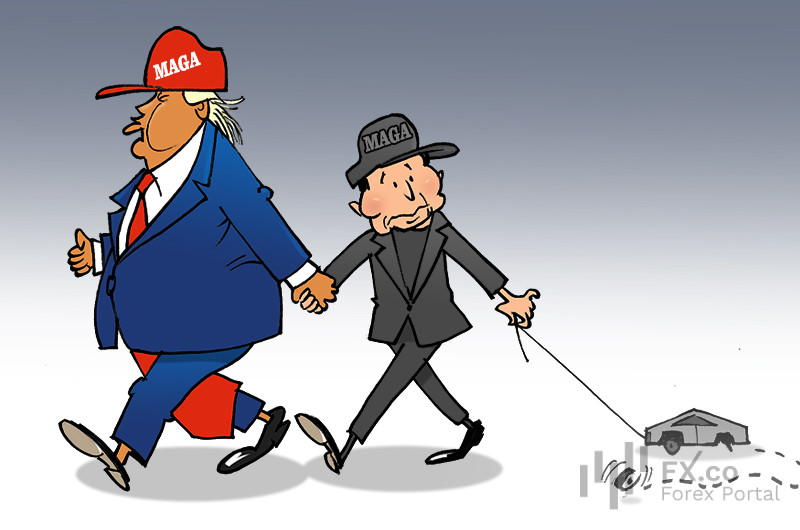

According to Gene Munster, a managing partner at Deepwater Asset Management, Tesla's recent decline is driven by investors adjusting their delivery expectations for 2025. In turn, this revision is linked to Elon Musk's growing political activity, which deters potential buyers. This sentiment has already been reflected in Tesla’s vehicle registrations in Europe. Sales in the EU plummeted by 45% year-over-year in January 2025, while Tesla’s market share in new car registrations fell to 1% from 1.8% in the same period of 2024.

Wall Street analysts expect Tesla’s deliveries to reach 2 million vehicles this year, but industry estimates are more modest at 1.7 million. If the worst-case scenario comes true, Tesla could face a tough year, as this forecast implies a 4% decline in annual deliveries. Nevertheless, Tesla’s management remains optimistic, still predicting a 12% growth in the annual rate.

Gene Munster says Tesla stock may not bottom out until the company’s official delivery forecasts align with lower industry estimates. Despite the current downturn, the expert is bullish about Tesla’s future. He believes that the company is laying the groundwork for a strong 2026, when the stock will benefit from the more affordable model. Notably, the production of the new model will be launched in the first half of 2025.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română

Comments: