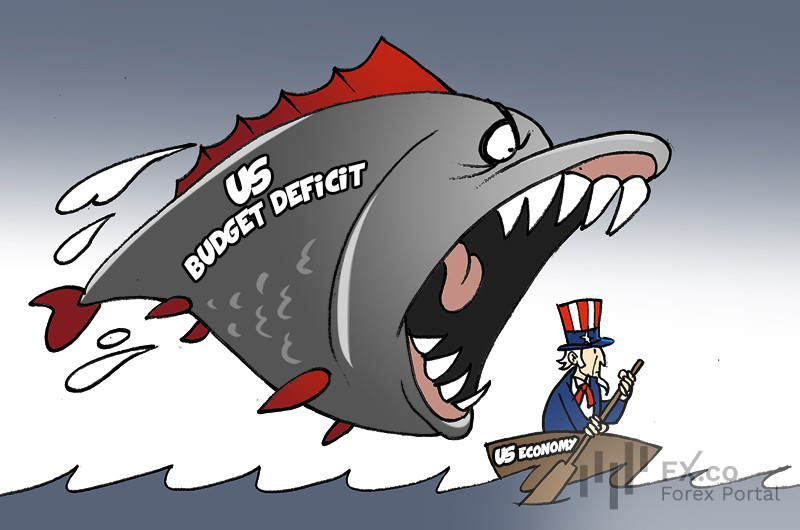

According to Reuters, over the next decade, the US federal budget deficit is expected to be nearly $1 trillion higher than projected by the Congressional Budget Office. This marks a significant deterioration in the country’s fiscal outlook and highlights the urgent need for policymakers to address the situation. The higher-than-expected deficit is primarily attributed to prospective changes in tax and fiscal legislation, as well as the potential impact of new tariffs.

Preliminary estimates show that the cumulative budget deficit could total $22.7 trillion from fiscal year 2026 through 2035. Previously, before Donald Trump's return to the White House, the expectation was that the figure would not exceed $21.8 trillion.

Net interest payments on the national debt are forecast to reach $14 trillion over the next decade, rising from $1 trillion or 3.2% of GDP in 2025 to $1.8 trillion or 4.1% of GDP in 2035.

The current forecast is based on changes in legislation and tariffs set to take effect in January 2025. However, the situation could deteriorate further if the US Court of International Trade overturns tariffs imposed by Trump.

An alternative scenario assumes an extension of several temporary tax cuts, including tax breaks on overtime work, tips, Social Security income, car loan interest, and higher state tax deductions. The list also includes local taxes and full expensing of factory investments. Over the next ten years, these changes would add $1.7 trillion to the US deficit.

Under the baseline scenario, the debt-to-GDP ratio is expected to increase from 118% to 120% by 2035. However, the alternative scenario suggests that it could climb as high as 134%.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română

Comments: