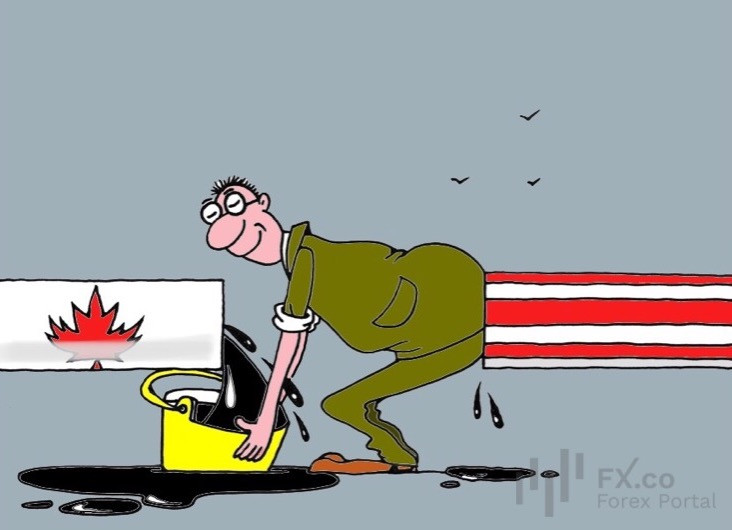

Beijing has targeted the US oil industry, a vital sector of the American economy, by sharply reducing its oil imports from the United States. What comes next?

According to Bloomberg, Chinese refineries are now importing Canadian oil at record levels, while imports of US crude have plunged by 90% amid escalating trade tensions. Nearly a year ago, a new pipeline in western Canada expanded access for China and other East Asian buyers to Alberta’s vast oil sands reserves.

Bloomberg reports that in March, Canadian crude oil exports to China via Vancouver surged to an unprecedented 7.3 million barrels. Data from Vortexa Ltd., a company that tracks marine shipments of oil and gas, suggests this figure may climb even higher in April. In contrast, Chinese imports of US crude dropped to 3 million barrels per month, a steep decline from 29 million barrels in June 2024.

This shift in North American oil flows to China, still the world’s largest crude importer, illustrates the economic and strategic disruptions triggered by President Donald Trump’s overhaul of global trade relations. “Given the trade war, it is unlikely for China to import more US oil,” Wenran Jiang, president of the Canada-China Energy & Environment Forum, said. “Anything from Canada will be welcome news,” he added.

While North American hydrocarbon exports to China remain smaller than shipments from the Middle East or Russia, Canada’s oil sands help to meet the needs of several countries. These sands are among the few sources of relatively cheap, high-sulfur crude, a type ideally suited to most Chinese refineries. For Asian processors, oil from the Middle East with similar properties, such as Iraq’s Basrah Heavy, is more expensive than Alberta’s crude.

Français

Français

Русский

Русский English

English Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română

Commentaires: