Analýza obchodov a tipy na obchodovanie s britskou librou

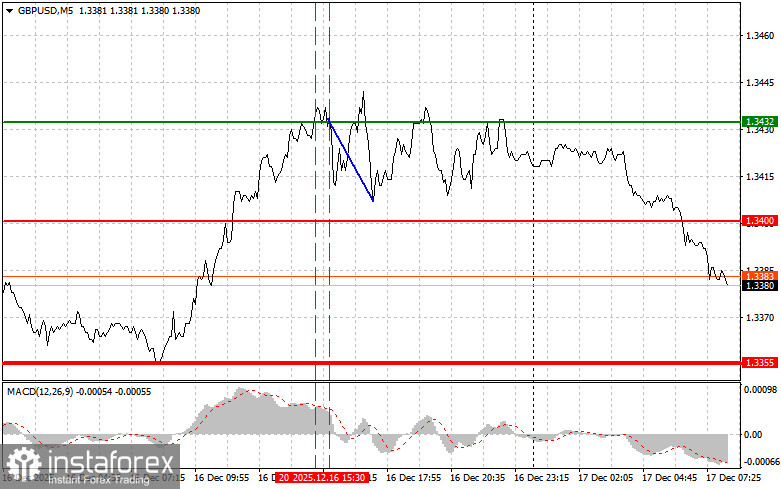

Cena otestovala úroveň 1,3432, keď indikátor MACD už výrazne vzrástol z nuly, a už dlhší čas bol v prekúpenej oblasti. Cena otestovala túto úroveň druhýkrát, vďaka čomu bolo možné zrealizovať predajný scenár č. 2, čo viedlo k poklesu páru o 20 pipov.

Dolár prudko klesol, zatiaľ čo britská libra posilnila po správach, že miera nezamestnanosti v USA dosiahla 4,6 %. Tieto údaje vyvolali vážne obavy o zdravie americkej ekonomiky a vyhliadky na ďalšie zníženie úrokových sadzieb Federálnym rezervným systémom. Britská libra si však nedokázala udržať svoju vedúcu pozíciu dlho.

V prvej polovici dnešného dňa sa očakáva zverejnenie viacerých dôležitých ekonomických ukazovateľov Spojeného kráľovstva: index spotrebiteľských cien, ukazovatele výrobných cien a index maloobchodných cien. Tieto údaje budú slúžiť ako kľúčové informácie o stave britskej ekonomiky a ovplyvnia budúce rozhodnutia Bank of England o menovej politike. Najväčšiu pozornosť bude venovaná indexu spotrebiteľských cien, ktorý je primárnym ukazovateľom inflácie v krajine. Pokračujúci rast tohto indexu pravdepodobne donúti centrálnu banku zvážiť udržanie úrokových sadzieb na súčasnej úrovni. Dôležitý je aj index cien výrobcov, ktorý odzrkadľuje dynamiku cien surovín a tovarov, s ktorými sa výrobcovia stretávajú. Nárast tohto indexu môže signalizovať budúce zrýchlenie inflácie, keďže výrobcovia pravdepodobne prenesú tieto vyššie náklady na spotrebiteľov.

Spoločne tieto ukazovatele poskytnú ucelený obraz o súčasnej inflačnej situácii v Spojenom kráľovstve a umožnia posúdiť vyhliadky hospodárskeho rastu v nadchádzajúcich mesiacoch.

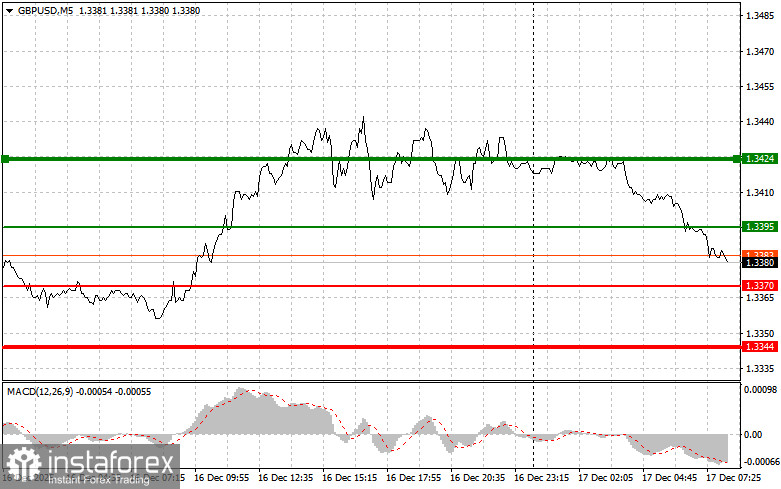

Pokiaľ ide o intradenné obchodovanie, plánujem postupovať na základe scenárov č. 1 a č. 2.

Nákupný scenár

Scenár č. 1: dnes plánujem kúpiť libru, keď cena dosiahne bod vstupu na trh v oblasti úrovne 1,3395 (zelená čiara na grafe), pričom očakávam, že vzrastie na úroveň 1,3424 (hrubšia zelená čiara). V blízkosti tejto úrovne zatvorím dlhé pozície a otvorím krátke pozície v opačnom smere (počítam s pohybom vo veľkosti 30 ‒ 35 pipov od tejto úrovne). Silný rast libry je možný iba v prípade priaznivých údajov. Dôležité! Pred nákupom sa uistite, že indikátor MACD je nad nulovou hodnotou a práve z nej začína rásť.

Scenár č. 2: nákup libry dnes plánujem aj v prípade, že cena dvakrát po sebe otestuje úroveň 1,3370, keď sa indikátor MACD bude nachádzať v prepredanej oblasti. To obmedzí potenciál páru klesať a povedie k obratu trhu smerom nahor. Môžeme očakávať rast k úrovniam 1,3395 a 1,3424.

Predajný scenár

Scenár č. 1: dnes plánujem predať libru po dosiahnutí úrovne 1,3370 (červená čiara na grafe), čo povedie k rýchlemu poklesu páru. Hlavný cieľ predávajúcich je na úrovni 1,3344, kde zavriem krátke pozície a okamžite otvorím dlhé pozície v opačnom smere (počítam s pohybom vo veľkosti 20 ‒ 25 bodov od tejto úrovne). Predávajúci budú aktívni v prípade slabých údajov. Dôležité! Pred predajom sa uistite, že indikátor MACD sa nachádza pod nulovou hodnotou a práve z nej začína klesať.

Scenár č. 2: dnes plánujem predať libru, keď cena dvakrát po sebe otestuje úroveň 1,3395, keď sa indikátor MACD bude nachádzať v prekúpenej oblasti. To obmedzí rastový potenciál páru a povedie k obratu trhu smerom nadol k úrovniam 1,3370 a 1,3344.

Čo je na grafe:

- Tenká zelená čiara ‒ vstupná cena, za ktorú môžete kúpiť obchodný nástroj.

- Hrubá zelená čiara ‒ odhadovaná cena, pri ktorej môžete nastaviť take profit alebo manuálne vybrať zisky, pretože ďalší rast nad túto úroveň je nepravdepodobný.

- Tenká červená čiara ‒ vstupná cena, pri ktorej môžete obchodný nástroj predať.

- Hrubá červená čiara ‒ odhadovaná cena, pri ktorej môžete nastaviť take profit alebo manuálne vybrať zisky, keďže ďalší pokles pod túto úroveň je nepravdepodobný.

- Indikátor MACD ‒ dôležitý pri identifikácii prekúpených a prepredaných zón s cieľom urobiť rozhodnutie o vstupe na trh.

Dôležité: Začínajúci forexoví obchodníci by mali robiť rozhodnutia o vstupe na trh veľmi opatrne. Aby ste predišli prudkým cenovým výkyvom, je najlepšie nevstupovať na trh pred zverejnením dôležitých fundamentálnych správ. Ak sa rozhodnete obchodovať počas zverejňovania správ, vždy nastavte príkazy stop, aby ste minimalizovali straty. Bez príkazov stop môžete rýchlo prísť o celý svoj vklad, najmä ak nevyužívate money management a obchodujete veľké objemy.

Nezabúdajte, že na úspešné obchodovanie potrebujete jasný obchodný plán, ako je napríklad ten, ktorý je uvedený vyššie. Prijímanie spontánnych obchodných rozhodnutí na základe aktuálnej situácie na trhu je pre intradenného obchodníka vo svojej podstate stratová stratégia.

Slovenský

Slovenský

Русский

Русский English

English Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română